Today, the economy moves faster than ever before. As Mergers and Acquisitions activity becomes more rapid, third-party risks grow more complex and compliance regulations are tightening around the world, performing accurate and comprehensive due diligence is no longer just an option or checkbox, it is a strategic investment. Real time insights, contextual understanding and sentiment analysis and automation is where typical due diligence meets strategy, enabling better business.

Why Basic KYB/KYC is no longer sufficient

Risk assessments were traditionally done during major transactions of Mergers and Acquisitions and high-value business partnerships. However, in today’s world risks are no longer static and traditional due diligence processes no longer reflect real time insights. ESG violations, sanctions breaches or governance failures can happen at any time, and traditional due diligence relying on NGO reporting or self-reporting no longer reflects failures in adequate timing. These failures can have negative impacts. For this reason, third party onboarding, supplier vetting and due diligence requires a smarter approach which monitors risk continuously.

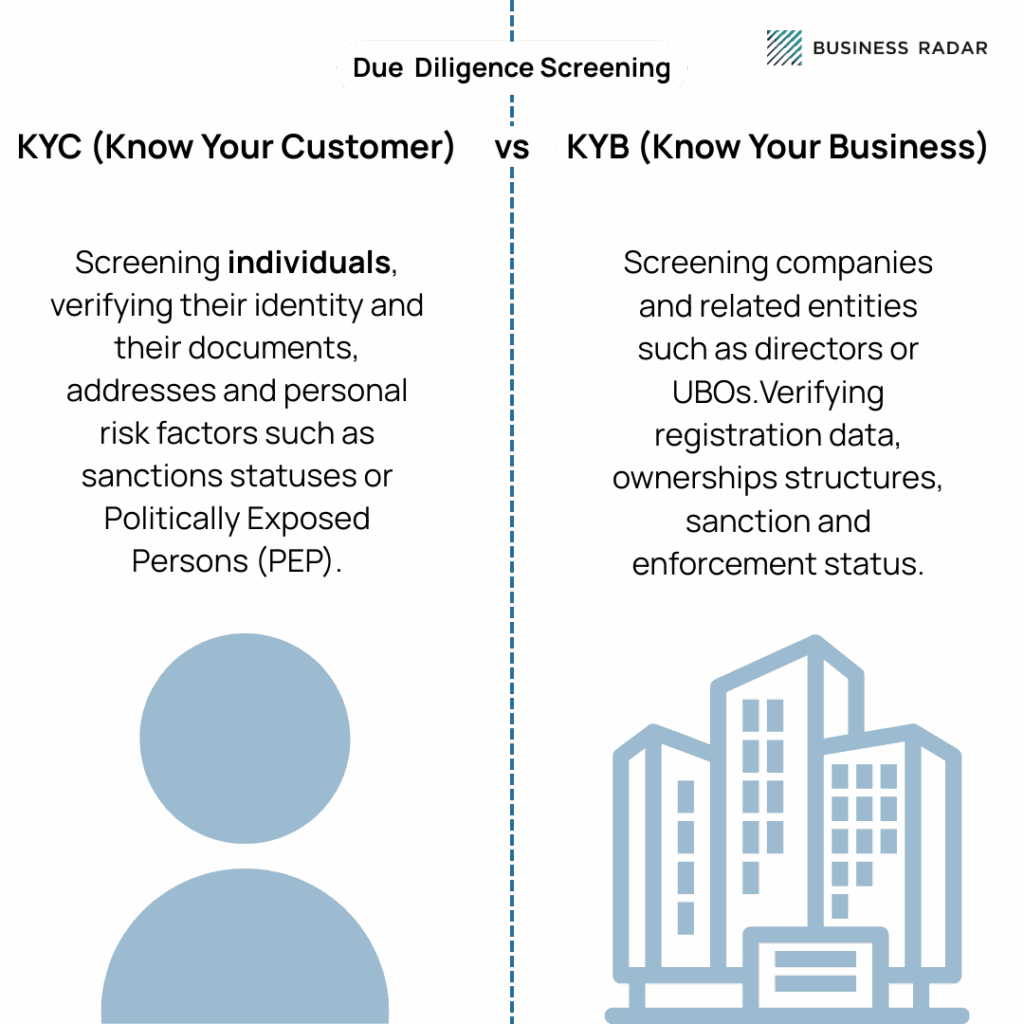

The kyb-kyc difference has become more pronounced as companies take due diligence more seriously as a strategic tool instead of ticking regulatory boxes.

KYC (Know Your Customer) focuses on individuals, verifying the identity of individuals and their documents, addresses and personal risk factors such as sanctions statuses or Politically Exposed Persons (PEP).

KYB (Know Your Business) focuses the screening of companies and their related entities. It focuses on verifying registration data, ownerships structures, UBOs (Ultimate Beneficiary Owners) and screening risk factors such as sanctions and enforcement status.

Without ongoing and real time monitoring, static KYB profiles quickly become outdated. Manual processes and one-time onboarding checks can no longer keep up with real-world risk, especially since the use of layered ownership, fake shell entities and creative ways fraudsters use to commit fraud and crime.

Key Features of Business Radars Due Diligence Tools

Tools like Business Radar enhance and build upon traditional KYB-check processes through automation, intelligence and scale. Some core features powering better due diligence include:

- Automated KYB Checks, helping to validate companies against registries from SMEs to MNE conglomerates, with a 99% coverage rate.

- Integrated Adverse Media Monitoring, using Business Radar to scan sources in over 100 languages from mainstream and local gazette media in over 190 countries. With over 150 million sources, integrated adverse media monitoring helps recognize risk or fraud allegations in real time.

- With over 200 predefined risk categories and AI based Natural Language Processing to categorize risks into contexts, allowing to act on what matters to the business. Customized alerts can also be triggered based on risk profiles.

- Portfolio management and usability features including portfolios and binders for seamless monitoring, collaboration and organization. This helps compliance teams align on risk profiles, enabling better efficiency and turning the focus to what matters most: making key decisions.

- API Integration and SSO to allow Business Radar to connect to your existing systems, including CRM or internal compliance software. Business Radar integrates with enterprise tools for secure, efficient workflows.

- Real time alerts and continuous monitoring, allowing notifications to be set up the moment something changes. Business Radar’s solution reflects changes in real time to ensure you always stay ahead of the curve.

For example, a Private Equity firm may vet an acquisition using Business Radar to perform automated KYB checks. They may initially see that everything is compliant, with calid registration and good ESG scores. However, Business Radar can flag adverse media mentions involving subsidiaries, which may be under investigation. This red flag would be indicated to the PE firm, and they may renegotiate terms or build safeguards into the contract. Without a tool offering real time media insights, this risk may have gone unnoticed.

Clients use Business Radar across various industries to power their due diligence and risk activities. For example,

- Financial institutions use Business Radar to screen new clients, partners or investments

- Multinationals and companies with complex supply chains use Business Radar to monitor portfolios of suppliers and vendors

- Consulting firms use Business Radar to strengthen their compliance advisory for ESG and AML.

Companies like Atradius and Deloitte have rolled Business Radar out in teams globally, utilizing adverse media summaries, dashboard s and compliance screening for their due diligence processes and investment strategies.

To learn more about Business Radar’s all in one compliance solution can help in your risk assessment process, book a free demo.