PEP, Sanctions & Enforcements Screening

Mitigate financial, regulatory, and reputational risks with deep global coverage and smart automation.

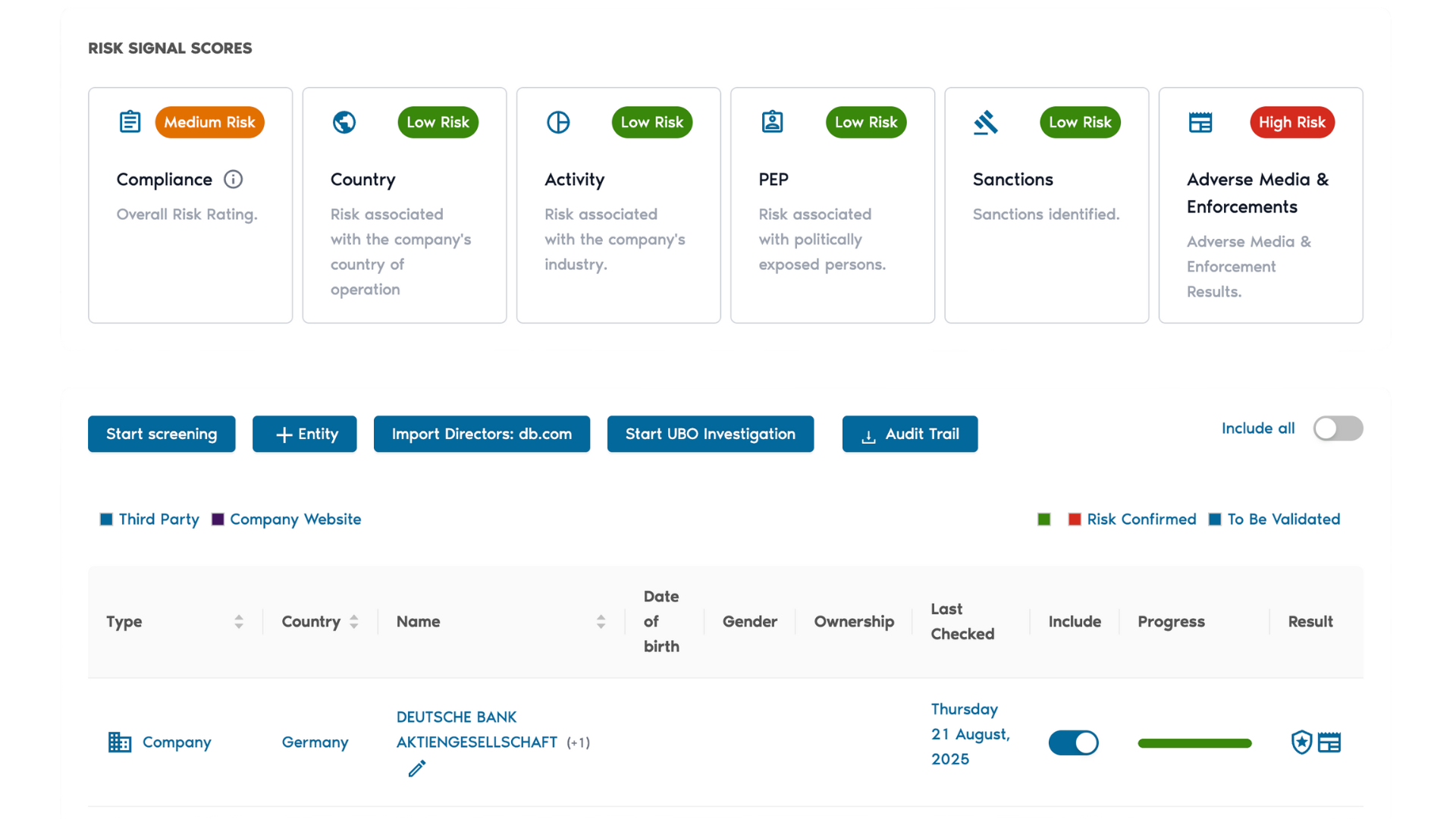

Business Radar brings sanctions, PEP, enforcement, and UBO checks into one platform. With broad coverage, reduced false positives, and transparent reporting, compliance teams gain the tools they need to act quickly, stay compliant, and protect their organisations.

Trusted by

Business Radar: Comprehensive Compliance and Risk Management

The time of an auditor, risk manager, or KYC analyst is too valuable to spend on endless browsing and filtering of information. What matters is accurate results, clear audit trails, and confidence that your organisation is fully compliant.

Business Radar offers a cutting-edge solution for businesses seeking comprehensive compliance and risk management. By combining advanced PEPs & Sanctions checks with extensive risk data, Business Radar ensures your business is protected against financial, regulatory, and reputational risks. Our solution is trusted by leading companies globally, offering unmatched coverage and expertise.

Global PEPs & Sanctions Checks

Benefit from the most comprehensive and up-to-date PEP and sanctions databases, covering individuals, organisations, and businesses from across 195 countries.

AML and Compliance

Navigate global regulatory changes confidently with tools designed for the latest Anti-Money Laundering (AML) directives compliance.

Adverse Media Screening

Utilize our extensive database compiled from over 150 Milion news sources worldwide and in any language to stay informed about potential reputational risks.

Ongoing Monitoring

Business Radar continuously scans for new risk signals across all entities previously reviewed. This proactive approach guarantees that your business swiftly adapts to any changes.

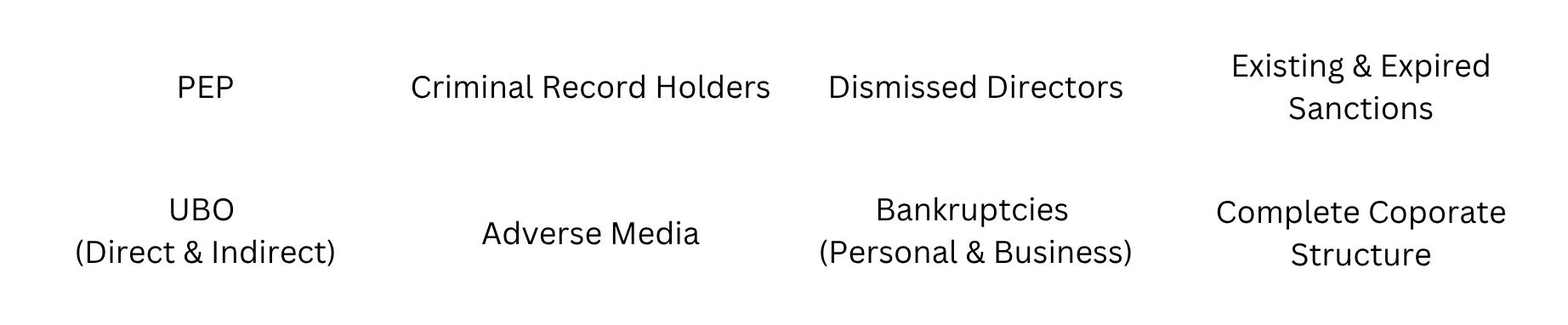

Every data point required for comprehensive due diligence centralized in one location:

How Business Radar enables your team to excel

We develop features with and for our community of compliance managers. Whilst doing this, we have one goal: to make compliance faster, more accurate, and easier to defend in audits.

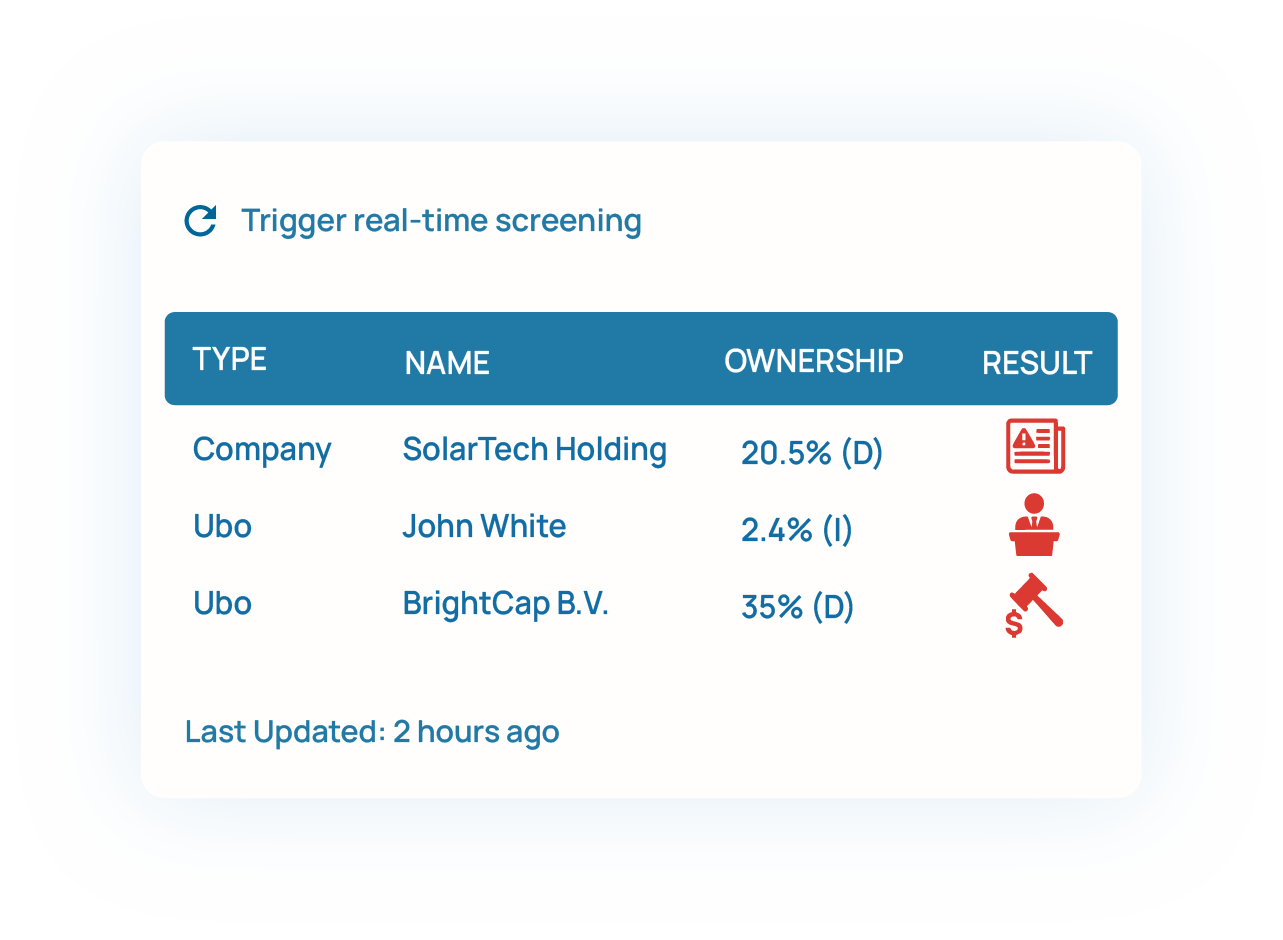

Portfolio Screening Without Limits

Upload entire portfolios with a few clicks or via integration. A wide range of identifiers including local registration numbers and D-U-N-S® numbers through our Dun & Bradstreet partnership ensure oustanding matching quality. The upload only takes a couple of minutes so that you can continue with your work without big interruptions.

Screen your entire portfolio against sanctions, enforcement, and PEP results with just a few clicks and see the result in a comprehensive overview.

Ongoing Monitoring

We continuously track your portfolios and alert you as soon as an entity becomes sanctioned or flagged in adverse media. Teams act immediately instead of waiting for third-party notices.

Shared Compliance Results

Screening results are visible across the organisation, with the date of the last check included. This prevents duplicate work, saves costs on billed checks, and ensures managers always see the latest risk status.

No more blind spots. See how our PEP & sanctions screening works in action.

Get in touch with us for

%

Auditors using Business Radar have reported a 32 percent average increase in efficiency during periodic reviews and screenings, compared to traditional software.

Industry examples

Finance & Banking: Automate KYC onboarding, flag adverse media early, and document sanctions checks with audit-ready reports.

Insurance: Monitor clients for reputational or solvency risks, track enforcement actions, and prevent policy exposure to sanctioned entities.

Supply Chains: Verify suppliers across complex ownership chains, uncover offshore links, and comply with international trade regulations.