Speed Up Your AML Checks Online with Business Radar

Business Radar allows KYC and Compliance Teams to conduct B2B AML checks in a fast and efficient manner. No more endless spreadsheets.

Key features of Business Radar

Automated AML Checks

Perform fast and reliable online money laundering checks with real-time data.

Compliance Monitoring

Stay up-to-date with changing AML regulations across jurisdictions, ensuring full compliance.

Risk Scoring

Identify high-risk individuals or entities using intelligent risk-scoring algorithms.

Secure & User Friendly Platform

Safeguard sensitive data with top-tier encryption while enjoying an intuitive interface suitable for all users.

The Challenges of Traditional AML Checks

Time-Consuming: Manual anti money laundering checks slow down business operations and risk assessment.

Complex Compliance: Navigating the maze of AML regulations can be daunting without automated tools.

Inconsistent Data: Relying on incomplete or outdated data increases your exposure to financial crimes.

Resource Intensive: Conducting comprehensive AML checks online without proper software consumes valuable time and resources.

AML Checks with Business Radar

Save Time: Automate tasks and complete AML checks in seconds.

Ensure Compliance: Mitigate risks by staying aligned with AML laws globally.

Reduce Costs: Minimize operational costs associated with manual compliance checks.

Improve Accuracy: Access up-to-date, reliable data to make informed decisions.

Enhance Decision-Making: Act on comprehensive risk profiles to safeguard your business.

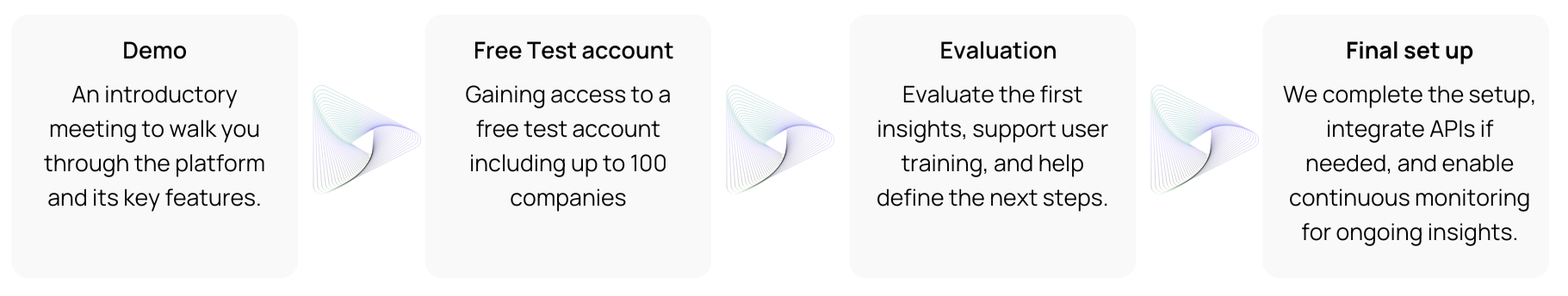

Book your free demo now!

Business Radar is a technology provider and does not offer legal or financial advice.

210+

Risk Categories

80%

Reduction False Positives

1.000.000+

Data Sources

100+

Translated Languages

1.400+

Sanction Lists

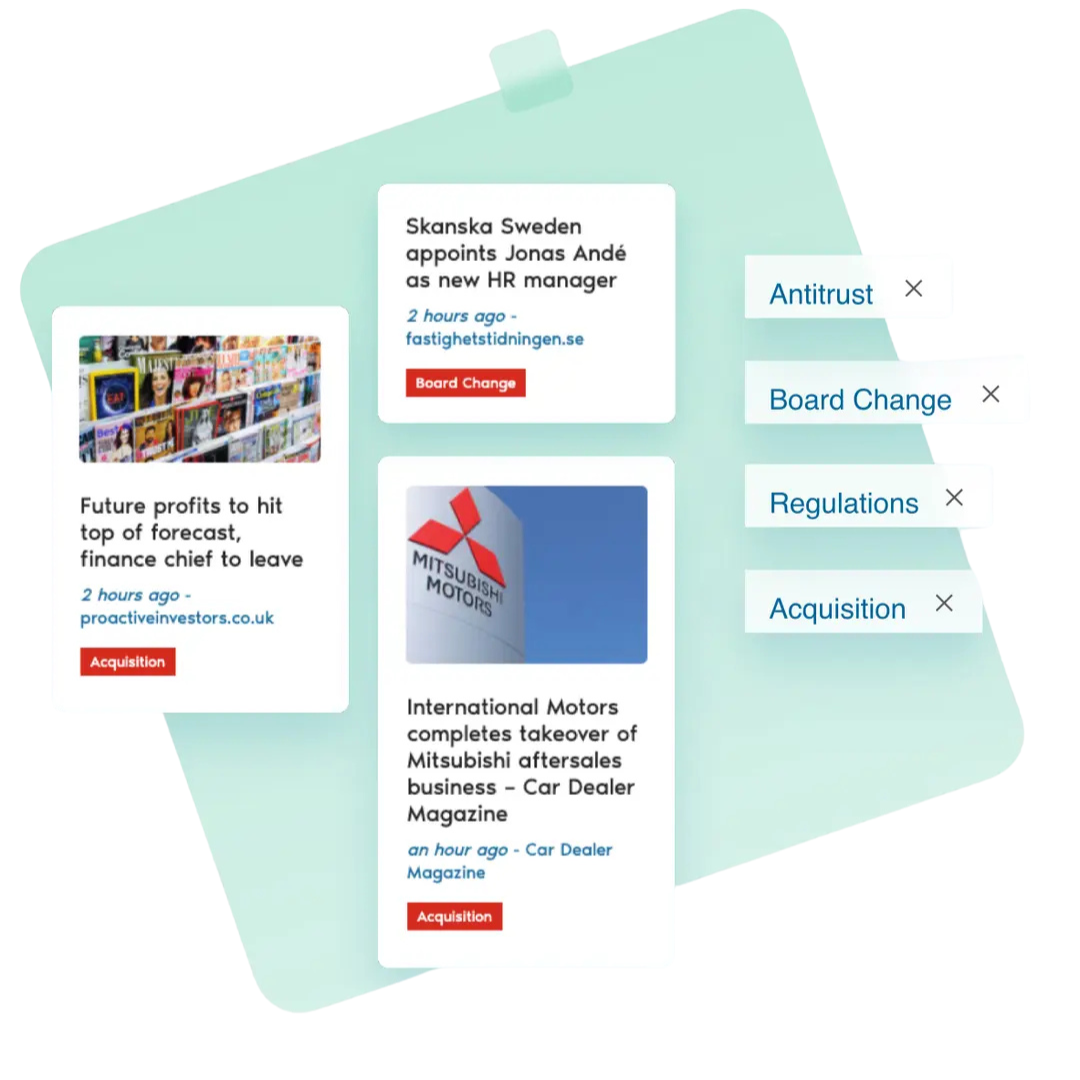

How Business Radar Works

Trusted by

“We enjoy working with Business Radar, Their service is fantastic, the collaboration has been exemplary and it has improved our business processes.”

Kiera Clifton

Senior Underwriter – Atradius

Frequently Asked Questions

What are AML checks?

AML (Anti-Money Laundering) checks verify whether customers or partners are involved in financial crimes, such as money laundering or terrorist financing.

Can Business Radar handle large volumes of AML checks?

Yes, our platform is designed for scalability, allowing you to perform bulk screenings efficiently.

How does Business Radar automate AML checks?

We use advanced algorithms and global databases to screen entities in real time, ensuring accuracy and compliance.

How does Business Radar ensure comprehensive risk coverage?

Business Radar offers unrivaled adverse media screening insights by scanning every corner of the globe in any language. With over 210 risk categories and an extensive real-time media database, our service ensures that you never miss an adverse event, providing precise and relevant risk assessments with our adverse media screening tool.

What are the benefits of API integration?

API integration allows for seamless system incorporation, enhancing your internal processes with our robust data streams. It ensures easy access to our services, making your risk management and compliance efforts more efficient.

Why are AML checks important for businesses?

AML checks protect businesses from financial crime, regulatory fines, and reputational damage by quickly identifying high-risk entities.

Can you explain the AI-powered analysis and how it minimizes false positives?

Our advanced AI technology is designed to minimize false positives by up to 90%. It focuses on true risk signals without compromise, curating the results to reduce noise and pinpoint genuine risks, providing you with a clear, actionable overview.

Don’t let slow AML checks affect your business.

Automate your AML processes with Business Radar to save time, reduce costs, and stay compliant.