Built for EU risk, compliance & ESG frameworks

Business Radar supports the regulatory and voluntary frameworks that govern ESG risk, compliance, and value-chain due diligence in the EU.

Designed for CSRD, CSDDD, and supervisory ESG and financial crime risk frameworks.

ISO 27001 certified • Fully GDPR Compliant • EU Data hosting

Trusted by enterprises around the globe

Business Radar supports regulatory and supervisory frameworks that require organisations to identify, monitor, and document ESG risks.

CSRD / ESRS

EU sustainability reporting

What it supports

-

ESG risk identification

-

Controversy monitoring

-

ESRS-aligned disclosures

CSDDD

EU value-chain due diligence framework

What it supports

-

Risk-based ESG identification

-

Subsidiaries and suppliers

-

Business relationships

Financial institutions

Supervisory ESG risk frameworks

What it supports

-

Portfolio-level ESG risk identification

-

Banks and insurers

-

Supervisory expectations

How Business Radar supports regulatory frameworks

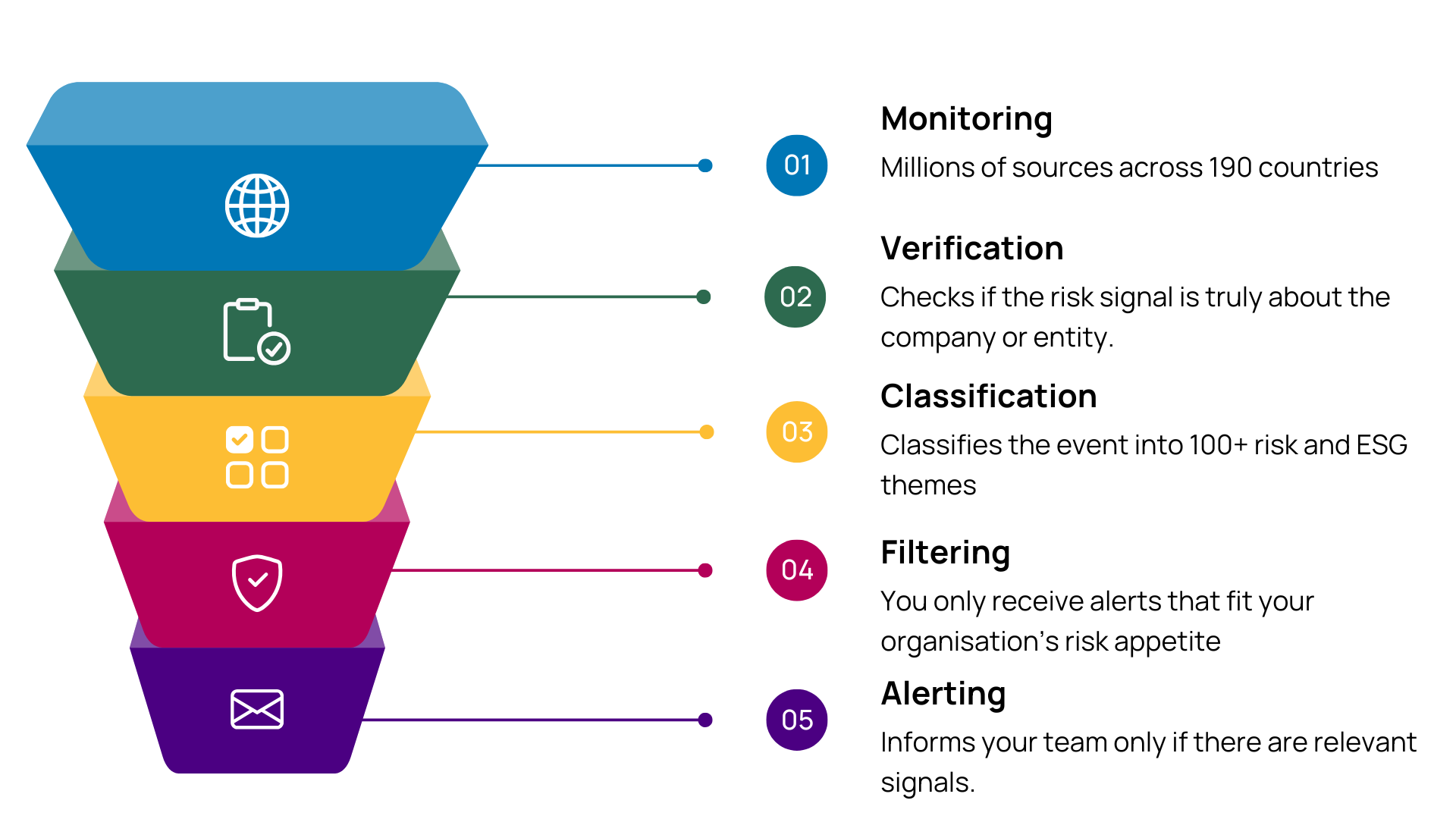

Business Radar provides risk signals across news, sanctions, PEP, enforcement, and related sources

For each company under monitoring, the platform verifies the relevance of the source, classifies events into defined risk and ESG themes, and applies filtering based on your organisation’s risk appetite.

This enables early visibility into financial crime, regulatory, and ESG risks, while ensuring teams focus only on signals that are relevant, explainable, and defensible.

The process produces structured, explainable inputs that organisations use to support regulatory reporting, due diligence, and supervisory risk monitoring.

Learn more about how this supports ESG risk management and adverse media monitoring.

CSRD / ESRS

EU sustainability reporting framework

What the framework requires

The Corporate Sustainability Reporting Directive (CSRD) requires organisations to identify, assess, and disclose material environmental, social, and governance (ESG) risks and impacts as part of their annual reporting.

Disclosures are structured under the European Sustainability Reporting Standards (ESRS), which require consistency, traceability, and supportable evidence for reported risks and impacts.

Where ESG controversies fit

ESG controversies and adverse media are relevant inputs for:

-

Identifying potentially material ESG risks and impacts

-

Supporting narrative disclosures under ESRS

-

Informing internal controls and assurance processes

External signals do not replace reporting obligations but provide evidence that ESG risks have been identified, assessed, and monitored.

How Business Radar supports CSRD / ESRS workflows

Business Radar supports CSRD-aligned reporting by:

-

Identifying ESG-related controversies across listed and unlisted entities

-

Verifying whether signals are relevant to the monitored company or entity

-

Classifying events into defined ESG risk themes

-

Providing explainable signals that can be referenced as supporting inputs in reporting and assurance workflows

Commonly used by

Organisations preparing CSRD disclosures across complex value chains, including manufacturing and supply-chain–intensive businesses.

CSDDD

EU value-chain due diligence framework

What the framework requires

The Corporate Sustainability Due Diligence Directive (CSDDD) requires organisations to identify, prevent, mitigate, and account for adverse human rights and environmental impacts across their own operations, subsidiaries, and business relationships.

Due diligence must be risk-based and extend beyond tier-1 suppliers where risk exposure warrants it.

Where ESG controversies fit

Ongoing monitoring of external information is a core component of risk-based due diligence, particularly for:

-

Identifying emerging risks in subsidiaries and suppliers

-

Prioritising due diligence efforts

-

Supporting escalation and remediation decisions

Adverse media serves as an early indicator of potential adverse impacts within the value chain.

How Business Radar supports CSDDD workflows

Business Radar supports CSDDD-related due diligence by:

-

Monitoring ESG-related controversies across subsidiaries, suppliers, and business partners

-

Applying verification to confirm relevance to the monitored entity

-

Classifying signals into environmental and social risk themes

-

Supporting continuous, risk-based monitoring rather than one-off assessments

Applicability thresholds, timelines, and national transposition requirements may evolve.

Financial institutions

Supervisory ESG risk oversight

What supervisory frameworks require

European supervisory authorities expect banks and insurers to identify, assess, and manage ESG-related risks across portfolios and counterparties.

These expectations extend to governance, risk management, and monitoring processes and emphasise the use of external and open-source information where relevant.

Where ESG controversies fit

ESG-related controversies may signal:

-

Financial and reputational risk

-

Counterparty risk exposure

-

Weaknesses in governance or controls

As a result, systematic monitoring of external information is relevant to portfolio-level ESG risk identification.

How Business Radar supports supervisory ESG risk oversight

Business Radar supports financial institutions by:

-

Enabling portfolio-wide adverse media screening across listed and unlisted entities

-

Verifying and classifying ESG-related risk signals

-

Supporting consistent, explainable risk identification across portfolios

-

Providing inputs that can be incorporated into supervisory risk monitoring processes

Applies across:

Banks, insurers, and other regulated financial institutions with portfolio-level ESG risk oversight obligations.

What you can do with Business Radar

Screen & monitor all companies

Track portfolios of any size across news, sanctions, PEP and enforcement sources.

See only relevant events

Receive signals that match your selected risk themes and organisational risk appetite.

Verify every signal automatically

Business Radar confirms whether a finding truly refers to the company or entity, reducing false positives.

Understand risk at a glance

Each event is categorised into the correct risk and ESG themes with clear context for review.

Review and act faster

Use one clean interface to assess mentions, sentiment, timelines and event impact.

Integrate with your workflow

Use the platform or bring results into your case systems with API, JSON, CSV or native integrations.

What Business Radar means for your team

1. Less manual searching

Your team spends less time trying to find relevant information and more time reviewing what matters.

2. A clearer view of your risk landscape

Events are grouped by risk theme, jurisdiction and severity, giving teams instant clarity on where to focus.

3. Fewer reviews, higher quality decisions

Analysts review fewer items overall but with richer context, which improves accuracy and reduces review fatigue.

4. A workflow that scales with your portfolio

Whether you track 500 companies or 50,000, Business Radar supports fast onboarding and monitoring without operational strain.

Book your free Business Radar demonstration now

Our experts are excited to meet you and find out how Business Radar can fit into your risk strategy.