Adverse Media & Risk Intelligence for Insurance Organizations

Smarter underwriting and portfolio management with global business coverage.

Built for Commercial Insurance

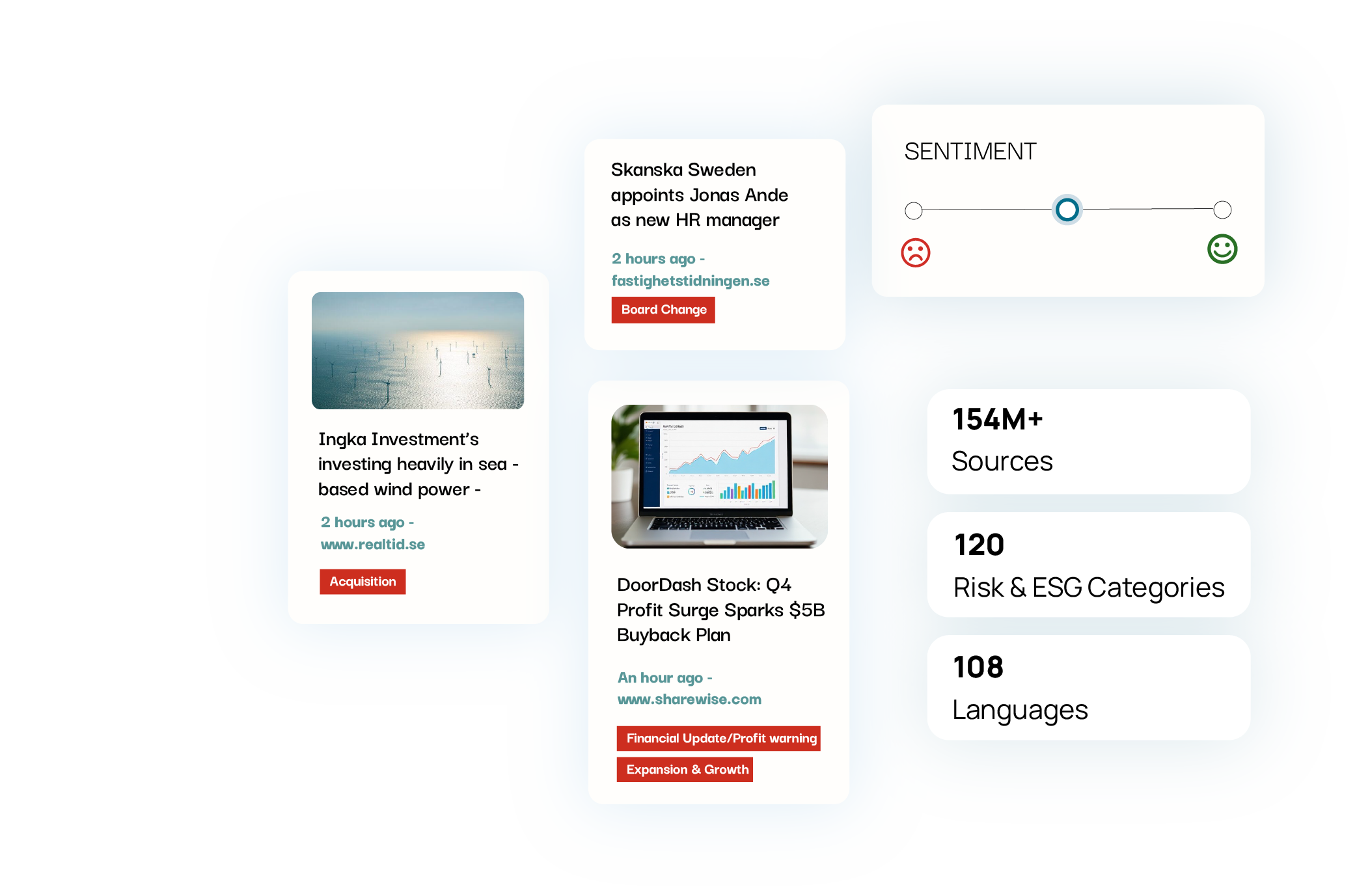

Insurance organizations face complex risks when working with corporate policyholders, counterparties, and portfolios. Adverse media signals such as regulatory fines, ESG controversies, labor disputes, or sanctions exposure can be just as critical as financial metrics in underwriting and portfolio management.

Unlike tools that are designed for personal or life insurance, Business Radar focuses on screening businesses. We provide insurers with transparency into the companies they underwrite, the entities they partner with, and the portfolios they manage across markets, sectors, and regions.

90% reduction of false positives in ongoing monitoring systems

200+ risk and ESG-related categories

135M + global company records including subsidiaries

Supporting Underwriting & Portfolio Oversight

Underwriting teams use Business Radar to identify red flags before approving new policies. Real-time adverse media monitoring highlights reputational and regulatory risks, while sanctions and ownership data provide a complete view of each business relationship. Insurers do not stop at detection. They use these insights to refine their risk strategies, adjust coverage terms, or escalate reviews for higher-risk applicants.

Portfolio managers use the platform to monitor entire books of business. Automated updates and alerts notify teams as soon as new risks appear. These signals allow insurers to reassess exposures, rebalance portfolios, and adapt their strategies to maintain resilience across regions and industries.

By combining comprehensive data with AI-driven precision, Business Radar gives insurers both the intelligence and the flexibility needed to make better-informed, forward-looking risk decisions.

Proven at Scale: Atradius

Atradius, a global leader in trade credit insurance, required a more efficient way to integrate adverse media into its underwriting process. The company began using Business Radar in two markets and has since expanded the platform to over 35 countries.

Features that Matter Most for Insurers

Full corporate structure visibility

Insurers can assess not only the direct policyholder but also subsidiaries, parent companies, and related entities to identify hidden risks.

Seamless portfolio management

Teams can upload or integrate portfolios without manual copying between tools. Business Radar syncs automatically with existing systems and supports unlimited portfolio updates within minutes.

Real-time awareness

Adverse media and sanctions alerts are delivered as soon as new information becomes available, keeping underwriting and portfolio teams continuously informed.

Scalable for global operations

Business Radar supports growth across markets and teams. Atradius, for example, expanded from a single-country implementation to adoption across 28 countries, ensuring consistent underwriting practices worldwide.

Why Insurers Choose Business Radar

Business Radar delivers:

-

Adverse Media Monitoring across 180+ countries and 100+ languages.

-

Corporate Entity Screening that connects sanctions, ownership, and media signals.

-

Portfolio Monitoring to track groups of clients or counterparties over time.

-

AI-Driven Precision that reduces false positives and highlights the signals that matter for underwriting and risk.

Confidence in Every Relationship

From underwriting new corporate policyholders to managing a global portfolio, Business Radar helps insurance organizations make faster, safer decisions — backed by the intelligence needed to meet regulatory and reputational expectations.