Written for: Compliance officers, risk managers, fintech leaders, procurement teams, and financial institutions

Discussed problem: How to verify business partners, avoid shell companies, and meet global AML/CTF regulations through KYB screening and automation.

Quick Answer: Why Is KYB Important?

Know Your Business (KYB) is the process of verifying the legitimacy and structure of companies you do business with. It protects your organization from financial crime, fraud, and regulatory violations. KYB checks are legally required under AML (Anti-Money Laundering) laws and help answer questions like:

- Is this company real and legally registered?

- Who are the ultimate beneficial owners (UBOs)?

- Is the company, or its people, on any sanctions, PEP, or watchlists?

- Is it safe to onboard this partner, vendor, or client?

KYB vs KYC: What’s the Difference?

| Factor | KYC (Know Your Customer) | KYB (Know Your Business) |

| Focus | Individuals | Companies, Entities |

| Purpose | Verify personal identity | Verify business legitimacy & ownership |

| Data Collected | Name, DOB, address | Registration data, UBOs, structures |

| Regulation Applies To | B2C (individuals) | B2B (entities and structures) |

When Do You Need a KYB Check?

- Onboarding a new B2B client

- Evaluating vendors or suppliers

- Entering joint ventures or partnerships

- Complying with AMLD5, FinCEN, FATF guidelines

What Does a KYB Check Include?

- Business Identity Verification

- Company name, registration number, incorporation documents, tax IDs.

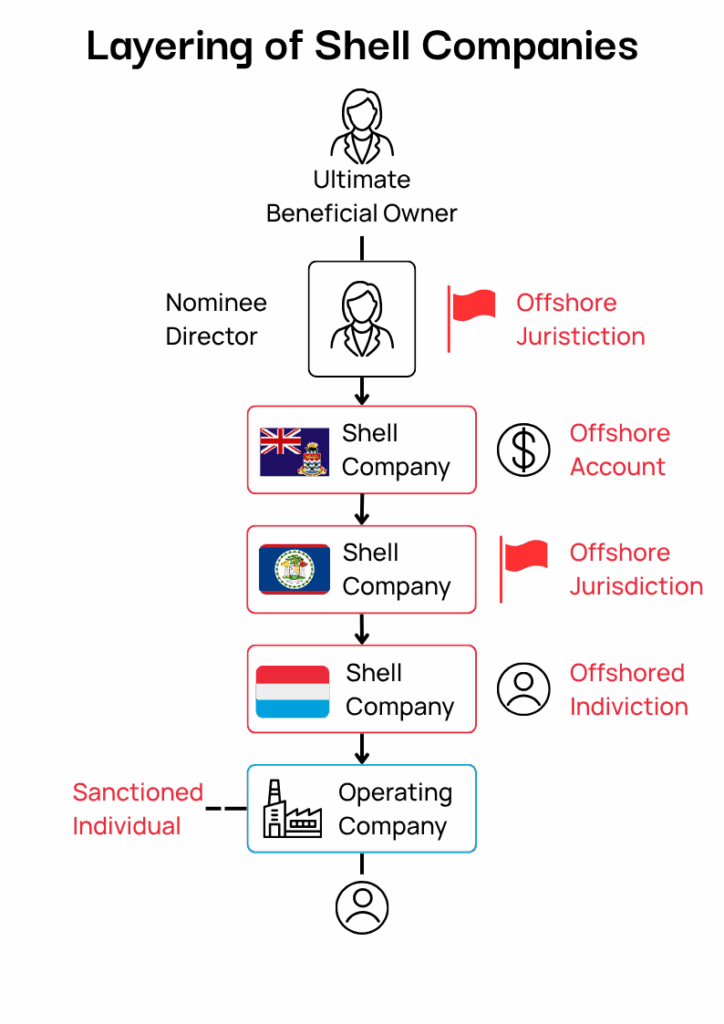

- UBO (Ultimate Beneficial Owner) Identification

- Detect individuals with ownership/control, even through layered structures.

- Sanctions, PEP, and Adverse Media Screening

- Check individuals and companies against global risk databases.

- Business Activity Assessment

- Understand industry, transaction type, jurisdictional risks.

- Ongoing Monitoring

- Alerting for ownership changes, risk score increases, legal or media exposure.

- Audit Trail for Regulators

- Ensure compliance with AML and CTF laws through documented due diligence.

Real-World Example: The Panama Papers

In 2016, the Panama Papers leak revealed how more than 200,000 shell companies were used to obscure beneficial ownership, evade taxes, and launder money. The scandal:

- Exposed how nominee directors enabled hidden control

- Revealed the limits of KYC-only checks

- Accelerated the global push for KYB regulations

Learn more from the ICIJ and Sueddeutsche Zeitung’s reporting on how global elites used shell companies to bypass financial oversight.

Global KYB Compliance Frameworks

| Regulation | Region | What It Requires |

| AMLD5 | EU | KYB in Anti Money Laundering Directive 5 (AMLD5) is mandatory in identifying the Ultimate Beneficiary Owner (UBO) of an entity. Verifying the identity and ownership structure of customers is a required step, especially for financial institutions |

FinCEN CDD Rule | US | Under the U.S Bank Secrecy Act, FinCEN requires financial institutions to implement Customer Due Diligence Rules (CDD) which encompasses KYB obligations. Similarly to ALMD5, companies must collect and verify beneficial ownership information of legal entities, helping detect suspicious activity. |

| FATF Recommendations | Global | The FATF sets global AML standards, and includes Recommendations 10 and 24, which mandate KYB for financial institutions and non-financial businesses. The recommendations include knowing the customer’s business structure, control mechanisms and verifying UBOs. |

How KYB Helps With B2B Risk Management

KYB is not just for banks. It’s a core part of vendor due diligence, B2B onboarding, and third-party risk management:

- Spot blacklisted vendors before contracts are signed

- Detect hidden ownership and links to sanctioned individuals

- Accelerate onboarding while ensuring compliance

KYB Technology: How Automation Reduces Risk

Modern compliance platforms like Business Radar use real-time data and AI to streamline KYB:

- Live Registry Checks

Connectors to sources like Companies House (UK), UBO Registers (EU), and Secretary of State (US). - UBO Graph Mapping

Automatically visualize control structures to uncover shell companies. - Event-Based Alerts

Get notified of changes in management, risk scores, or adverse media mentions. - Global Monitoring at Scale

Stay compliant in every jurisdiction with automated re-checks.

Typical Challenges KYB Tech Solves

- Manual document collection = slow onboarding

- Jurisdictional data gaps = blind spots in risk

- High false positives = poor signal-to-noise ratio

- No audit trail = exposure to regulatory fines

Why Choose Business Radar for KYB?

- Global company and UBO coverage

- Fast onboarding via automation

- Real-time alerts for risk changes

- Audit-ready documentation trail

- AI-enhanced compliance insights

Next Steps

- Explore KYB industry use cases on our Industries Page

- Book a free KYB demo with our team

- Download the KYB compliance checklist

Business Radar helps companies screen and monitor their business partners to stay compliant, reduce fraud risk, and onboard faster with confidence.