PEP, Sanctions & Enforcements Screening

Mitigate financial, regulatory, and reputational risks with deep global coverage and smart automation.

Business Radar combines global list coverage, smart relevance scoring, and multilingual news insights to help you spot real threats fast. Whether you’re onboarding, reviewing, or investigating. Get everything in one place.

Business Radar: Comprehensive Compliance and Risk Management

In an ideal world, we believe that the time of an auditor, risk manager, or KYC analyst shouldn’t be spent on extensive browsing and filtering of information but instead on actual investigation and risk assessment.

Business Radar offers a cutting-edge solution for businesses seeking comprehensive compliance and risk management. By combining advanced PEPs & Sanctions checks with extensive risk data, Business Radar ensures your business is protected against financial, regulatory, and reputational risks. Our solution is trusted by leading companies globally, offering unmatched coverage and expertise.

Global PEPs & Sanctions Checks

Benefit from the most comprehensive and up-to-date PEP and sanctions databases, covering individuals, organisations, and businesses from across 195 countries.

AML and Compliance

Navigate global regulatory changes confidently with tools designed for the latest Anti-Money Laundering (AML) directives compliance.

Adverse Media Screening

Utilize our extensive database compiled from over 150 Milion news sources worldwide and in any language to stay informed about potential reputational risks.

Ongoing Monitoring

Business Radar continuously scans for new risk signals across all entities previously reviewed. This proactive approach guarantees that your business swiftly adapts to any changes.

No more blind spots. See how our PEP & sanctions screening works in action.

Get in touch with us for

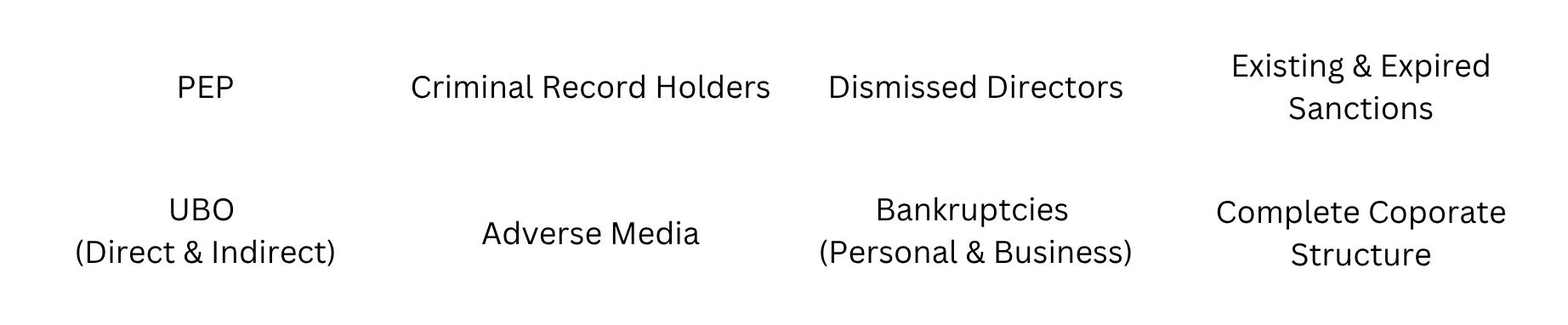

Every data point required for comprehensive due diligence centralized in one location:

%

Auditors using Business Radar have reported a 32 percent average increase in efficiency during periodic reviews and screenings, compared to traditional software.

Trusted by

Check out the Business Radar Blog for more insights

How SaaS Solutions Are Revolutionising KYC Compliance

KYC compliance is a critical safeguard against regulatory penalties and reputational damage. It’s what separates regulated institutions from operational and reputational risk. Traditional approaches to KYC are often inefficient, slow, and disconnected. Legacy...

Adverse Media Screening and AML Compliance: What Financial Institutions Need to Know

For financial institutions, one of the key responsibilities today is anti-money laundering (AML) compliance. Criminal networks are evolving faster than ever – moving vast sums across borders in seconds – and regulators are tightening expectations in response. In this...

What is KYB? The Know-Your-Business Verification and Compliance Process Explained.

What is KYB? Every year, the United Nations Office on Drugs and Crime (UNODC) estimates that between €715 billion and €1.81 trillion worth of money gets laundered (Europol, 2022). That’s roughly 2-5% of the worlds yearly Gross Domestic Product (GDP). Money that is...