Screening and monitoring that fits your risk strategy

Business Radar delivers accurate adverse media, sanctions and enforcement insights across financial crime, regulatory and ESG themes.

Covers your risk domains: from fraud, to money laundering and ESG.

ISO 27001 certified • Fully GDPR Compliant • EU Data hosting

Trusted by enterprises around the globe

What is Business Radar?

Business Radar gives you accurate, verified risk signals across news, sanctions, PEP, enforcement and more.

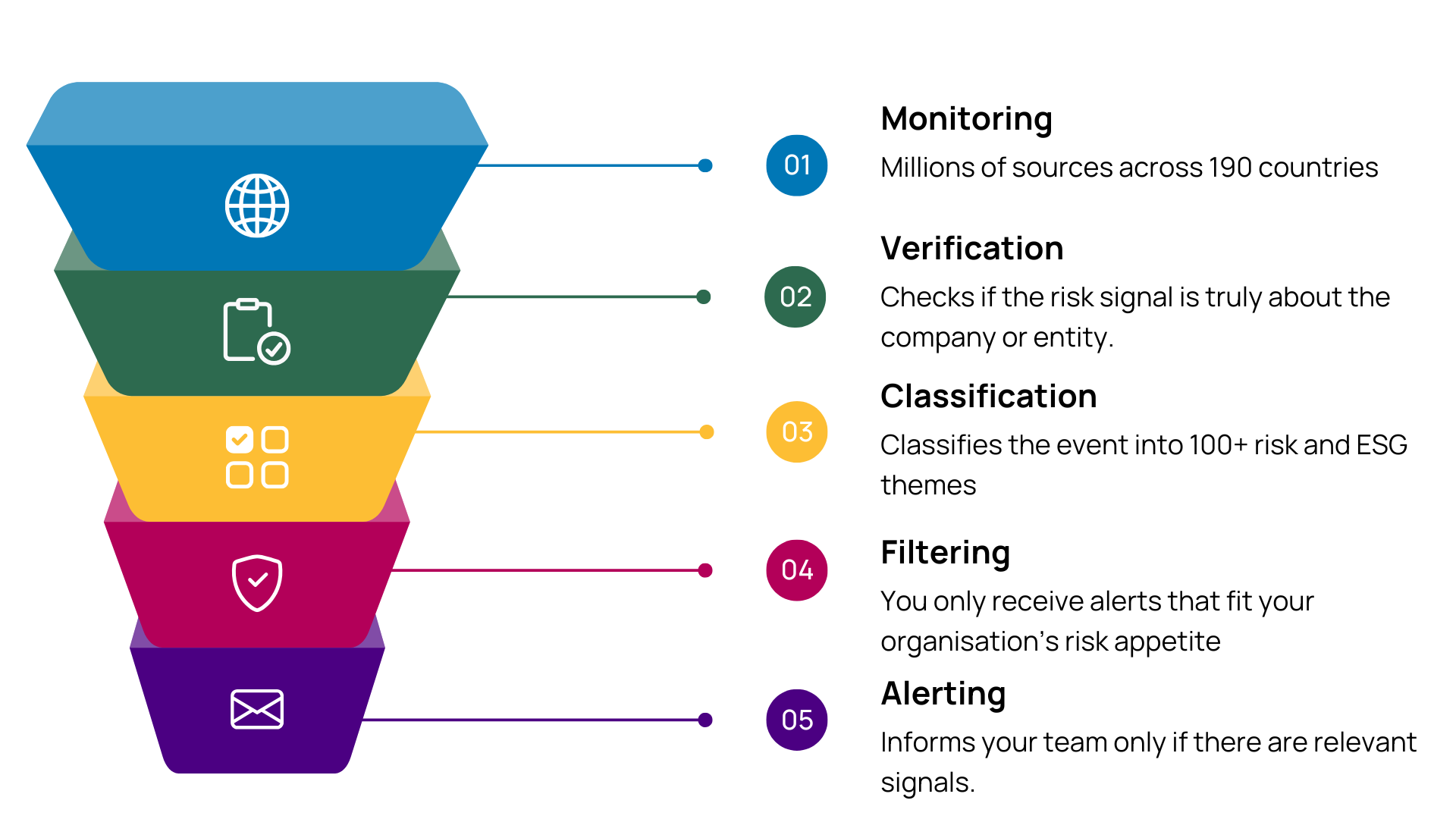

For every company under monitoring, the platform verifies the source, classifies the event into the right risk themes and filters alerts based on your organisation’s risk appetite.

You get early visibility into financial crime, regulatory and ESG risks. Business Radar brings you early visibility into the risk events that matter and filters out everything that does not.

5–20×

More Relevant Signals

including long-tail coverage of smaller companies and niche sources.

Up to 90%

Fewer False Positives

AI curation and GPT summaries for faster, more confident reviews.

154M Sources,

195 Countries

multilingual coverage in 108+ languages.

What you can do with Business Radar

Screen & monitor all companies

Track portfolios of any size across news, sanctions, PEP and enforcement sources.

See only relevant events

Receive signals that match your selected risk themes and organisational risk appetite.

Verify every signal automatically

Business Radar confirms whether a finding truly refers to the company or entity, reducing false positives.

Understand risk at a glance

Each event is categorised into the correct risk and ESG themes with clear context for review.

Review and act faster

Use one clean interface to assess mentions, sentiment, timelines and event impact.

Integrate with your workflow

Use the platform or bring results into your case systems with API, JSON, CSV or native integrations.

What Business Radar means for your team

1. Less manual searching

Your team spends less time trying to find relevant information and more time reviewing what matters.

2. A clearer view of your risk landscape

Events are grouped by risk theme, jurisdiction and severity, giving teams instant clarity on where to focus.

3. Fewer reviews, higher quality decisions

Analysts review fewer items overall but with richer context, which improves accuracy and reduces review fatigue.

4. A workflow that scales with your portfolio

Whether you track 50 companies or 50,000, Business Radar supports fast onboarding and monitoring without extra operational strain.

Book your free Business Radar demonstration now

Our experts are excited to meet you and find out how Business Radar can fit into your risk strategy.

Tailored Alerts That Put You in Control

Stay informed without overload.

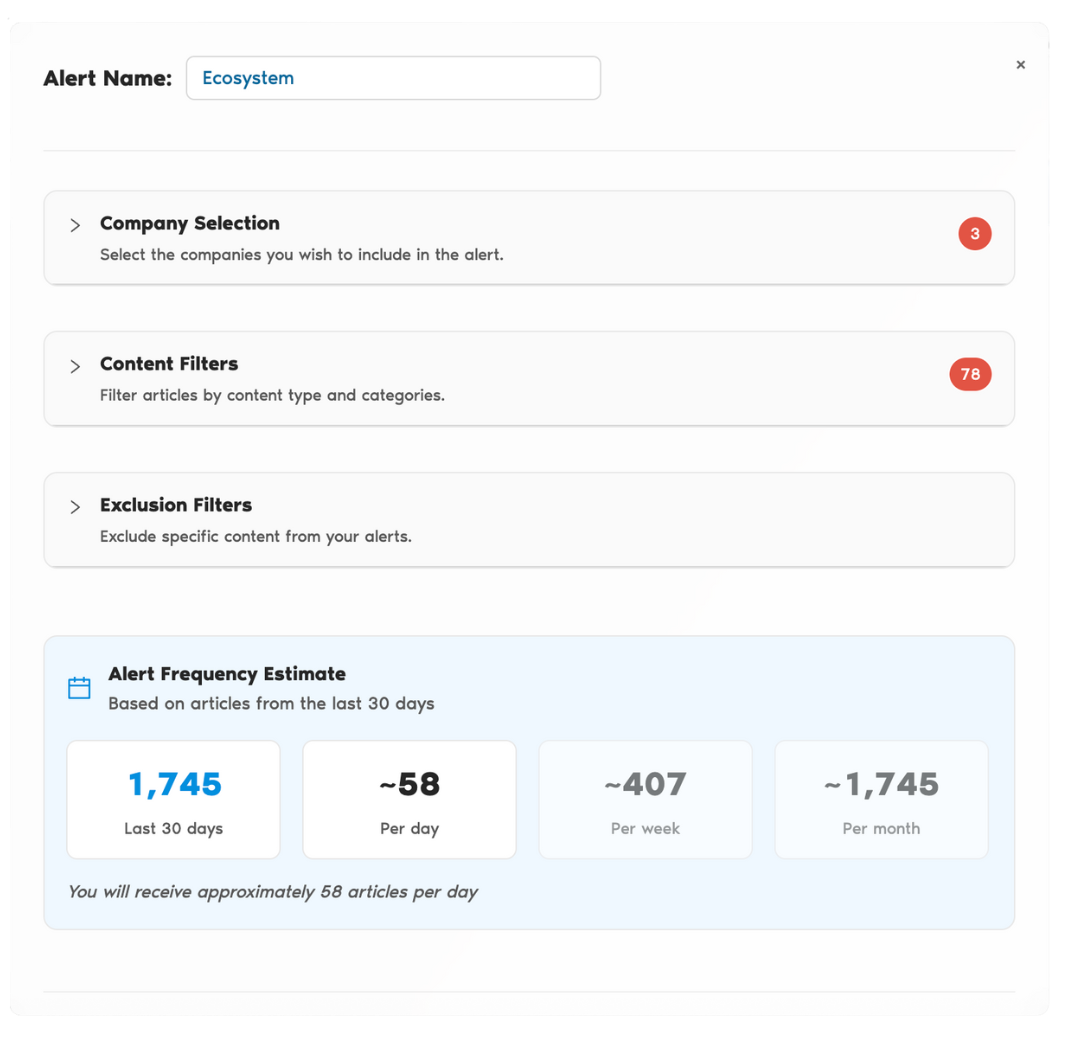

Business Radar’s alert system lets you configure exactly what kind of news you receive. To give you an idea about the volume of news, the system shows you expected volumes before you save an alert, so you can fine-tune for both relevance and workload.

Full Control Over What You See

-

Filter by 100+ risk categories or predefined sets (e.g., money laundering, antitrust, tax evasion, ESG breaches).

-

Narrow alerts by the country of the news source for jurisdiction-specific monitoring.

-

Apply alerts to all companies, selected portfolios, or entire industries.

Smart Alert-Count Prediction

-

See how many articles your alert settings would have triggered in the past 30 days.

-

Adjust instantly to balance coverage and review capacity

Spot Key Events at a Glance

Event Timeline

Visually track spikes in risk-related news with our interactive Event Timeline. It clusters articles by topic and volume so you can instantly see when and why a company’s risk profile changes, and drill down in seconds.

Gain Full Corporate Overview

In our highly globalised world, a company can easily have one or more subsidiaries abroad. That does not mean these companies are risk-free. Business Radar informs you about the corporate structure of a company, letting you gain the full picture of potential risks.

Frequently Asked Questions

What is adverse media screening?

Adverse media screening is the process of monitoring and analyzing news and media sources globally to identify negative news screening reports about individuals or entities that could indicate potential risk, such as financial fraud, regulatory breaches, or other types of misconduct.

Where do you get your company data?

We are an official partner of Dun & Bradstreet and access their entire database. If a company is not listed under their registery, an investigation with Dun & Bradstreet can be issues. Corporate Linkage and information about subsidiaries is also fetched from D&B.

How can I upload a portfolio?

You can use either a direct API, search for companies individually, or do an upload via Excel or CSV.

We identify companies using Dun & Bradstreet numbers, local regsitration numbers, and of course the company name.

Can you explain the AI-powered analysis and how it minimizes false positives?

Our advanced AI technology is designed to minimize false positives by up to 90%. It focuses on true risk signals without compromise, curating the results to reduce noise and pinpoint genuine risks, providing you with a clear, actionable overview.

How do I get started with Business Radar?

After activating your (trial) account, the first step is to create a portfolio. Once the portfolio has been created, you can add all the companies you want to screen or monitor. This can be done either automatically by importing a spreadsheet or manually by searching and selecting companies. Once your portfolio is complete, you have the option to screen and monitor companies directly within the platform, set up email alerts, or integrate signals into your own systems via the API.

What kind of support does Business Radar offer for regulatory compliance?

We offer comprehensive sanctions screening against over 1,400 sanction lists from 180 countries, an in-depth legal enforcement database, and real-time monitoring to ensure compliance with international regulations.