KYC compliance is a critical safeguard against regulatory penalties and reputational damage. It’s what separates regulated institutions from operational and reputational risk. Traditional approaches to KYC are often inefficient, slow, and disconnected. Legacy systems drag the process down with manual steps and outdated risk scoring and siloed tools, while financial criminals operate globally with increasing speed and sophistication. SaaS-based KYC platforms streamline compliance by unifying client screening, risk assessment, and ongoing monitoring.

With features like instant entity screening, real-time alerts, and historical adverse media checks, these platforms allow compliance teams to focus on meaningful review – not just checking at a surface level.

These systems scale with your needs and are updated automatically, ensuring alignment with shifting regulations.

From high-volume onboarding in digital banks to nuanced reviews in boutique firms, SaaS KYC platforms can improve accuracy and efficiency at every tier.

What SaaS Brings to KYC Services

SaaS-based KYC platforms streamline compliance by unifying client screening, risk assessment, and ongoing monitoring into a single, adaptive environment.

Rather than relying on piecemeal tools or manual review, KYC teams can implement software that evolves with regulatory requirements and supports multilingual, real-time processing.

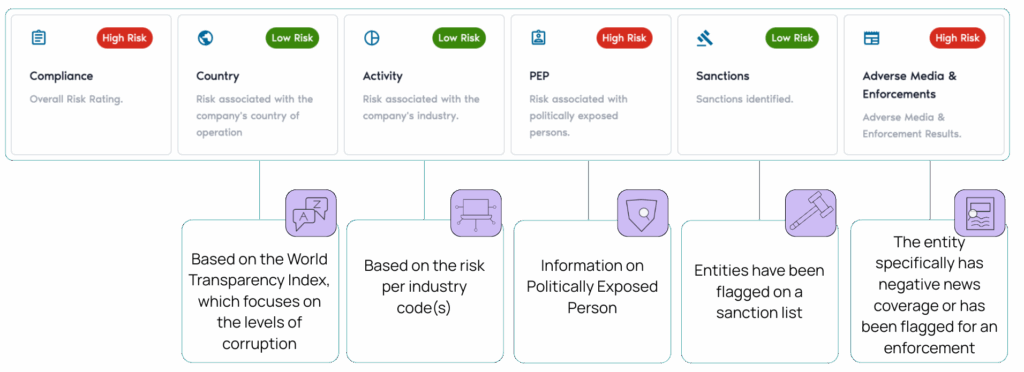

These platforms offer an array of configurable features, including risk scoring, adverse media checks, politically exposed persons (PEP) screening, and automated alerts – delivered through a single interface.

Crucially, SaaS KYC solutions are designed to integrate with existing compliance stacks. Institutions retain control over workflows and decision rules, while reducing operational friction.

By consolidating functionality into one platform, teams gain more consistent results, clearer audit trails, and the ability to manage KYC at scale – without sacrificing accuracy or control.

The Problem with Legacy KYC

For example, many financial institutions continue to rely on outdated, fragmented KYC systems that are no longer suited to today’s compliance demands.

Processes are slowed by spreadsheets, PDF exchanges, and siloed workflows – leaving compliance teams vulnerable to missed risks and inefficiencies.

Common challenges include:

- Lengthy onboarding timelines, sometimes measured in weeks

- Redundant reviews caused by disconnected systems

- Missed matches due to inconsistent data or language barriers

- High volumes of false positives, straining analyst resources

- Elevated operational costs due to manual oversight

More critically, these gaps increase the likelihood of overlooking material risks. Without real-time data and coordinated tools, adverse media mentions, sanctions list updates, or other red flags may go undetected until after exposure has occurred.

Legacy systems were not designed to manage modern regulatory expectations—or the pace and complexity of today’s global financial activity.

What Slows Down KYC – and What Speeds It Up

KYC delays often stem not from regulatory burdens, but from internal friction. Clients are asked to resubmit documents. Analysts lose time resolving false positives. And compliance managers lack visibility into case progress.

Key operational bottlenecks include:

- Incomplete documentation – A client submits a utility bill but omits valid ID. Days are lost in follow-up.

- Unclear workflows – No central ownership of the case, no record of current status.

- Disconnected tools – Screening software and onboarding systems don’t communicate.

- False positives – Common names trigger redundant investigations, diverting analyst attention.

Warning: This can even cost you customers – Customers dump Singapore’s banks over slow KYC

Compare this to a coordinated system:

- Clients upload documents directly to a secure portal. If something is missing, the system issues a real-time alert.

- KYC checks run automatically in the background. Sanctions list matches are flagged immediately; clean results move forward without delay.

- Review teams can assign, escalate, and annotate each case – ensuring clear accountability, auditability, and progress tracking.

With centralized controls and automated logic, KYC becomes not only faster – but more consistent, transparent, and auditable.

Why Cloud-Native KYC Beats Local Systems

Many institutions still operate KYC programs on local servers or legacy systems patched together over time. These environments lead to duplication, risk exposure, and unnecessary onboarding delays.

Cloud-native KYC platforms solve these problems by enabling teams across geographies to access and manage cases within a unified, real-time environment.

For example, if a client is flagged in one region, that information is immediately visible to teams elsewhere – eliminating the need for redundant reviews or external lookups.

Here’s what a centralized KYC system offers:

- Real-time case visibility across departments and jurisdictions

- Integrated case management, including shared annotations and approval trails

- Significant reduction in false positives, with some institutions reporting decreases of over 98%

- Robust audit logs, supporting internal reviews and external regulatory inquiries

This is not just a technology upgrade. It’s a shift toward operational maturity – replacing disconnected tasks with a cohesive, scalable compliance framework.

Smarter Risk Scoring Without the Overkill

Risk scoring in modern compliance should be explainable, dynamic, and actionable.

Rather than applying static thresholds or generic geographic flags, advanced SaaS KYC platforms use configurable models that adapt to a range of risk factors – without obscuring how scores are determined.

Key inputs include client industry, ownership structure, regulatory exposure, sanctions lists, and adverse media signals. Where applicable, systems should prompt confirmation of beneficial ownership – and whether those owners have been formally disclosed by the client.

These tools prioritize clarity. Compliance managers remain in control of escalation thresholds, workflows, and override settings. The software supports decision-making without replacing it.

Resource allocation also improves: low-risk cases are automatically advanced, while higher-risk profiles are flagged for deeper analysis. This allows teams to concentrate on exceptions instead of routine verifications.

By operationalizing these tools within a unified environment, compliance functions reduce noise, accelerate resolution, and meet documentation requirements more efficiently.

Real-World Use Cases

The operational demands placed on today’s compliance teams vary widely – but certain patterns have become standard across regulated industries:

- Wealth management firms face complex onboarding procedures involving layered ownership structures, politically exposed persons (PEPs), and cross-border documentation.

- Insurance companies have to keep track of huge portfolios on an ongoing basis to manage credit risks across clients.

These are not edge cases, they represent a growing segment of the financial landscape.

SaaS KYC platforms allow institutions to handle volume, complexity, and localization through a single platform without sacrificing oversight or transparency.

Why Your Compliance Team Will Actually Thank You

When KYC systems fail to support the workflows of compliance analysts, adoption lags and productivity suffers.

Worse, these old processes are stressful, time-consuming, and burning out your compliance team.

Survey Results: Compliance Officers May Experience Mental Health Issues In Part Because They Feel They Have ‘No Permission to Fail.’ – Corporate Compliance Insights

‘All the responsibility, none of the power’: Why compliance officers are burning out – Financial News (paywall)

Effective SaaS platforms, by contrast, reduce administrative overhead and give analysts the information they need to act with confidence.

Rather than switching between multiple tools or chasing incomplete data, analysts gain access to unified dashboards, configurable workflows, and real-time insights.

High-risk indicators, such as sanctions matches or negative media, are flagged automatically, while clean cases progress without unnecessary delays.

This reduces manual searching, improves focus, and helps mitigate the fatigue that contributes to high turnover in compliance roles.

By providing clear case context, audit history, and integrated decision logs, SaaS tools empower teams to work more strategically, and with far less friction.

A modern KYC environment is not just a compliance requirement. It’s an investment in analyst efficiency, retention, and institutional resilience.

Best Practices for Implementing SaaS KYC

Implementing a SaaS-based KYC platform requires more than deploying new technology. Without alignment across systems, teams, and governance, even advanced tools can fall short.

To ensure effective adoption:

- Integrate with existing systems – Avoid creating new silos; ensure real-time data flow across compliance functions.

- Configure risk thresholds – Align scoring models with your institution’s specific policies, jurisdictions, and escalation rules:

- Set alert logic thoughtfully – Balance sensitivity and specificity to avoid alert fatigue.

- Provide comprehensive training – Equip staff not just with platform use, but with decision frameworks that leverage the new tooling.

- Plan for scalability – Ensure the solution accommodates growth, cross-border onboarding, and future regulatory changes.

Technology alone doesn’t guarantee outcomes. Results come from how well the solution is embedded into daily operations, decision processes, and compliance governance.

A Note on Business Radar

For institutions seeking a purpose-built KYC solution, Business Radar offers multilingual screening, adverse media analysis, name matching, and fully configurable workflows.

The platform integrates into your existing compliance infrastructure and scales with evolving regulatory demands. Without the need for constant manual updates.

These capabilities are designed to support regulated entities in streamlining case reviews, reducing false positives, and meeting audit expectations with transparency and speed.

Final Word

KYC is no longer a back-office process. It’s a regulatory frontline. Yet in many organizations, it remains fragmented, underpowered, or delayed by outdated tools.

SaaS-based KYC platforms are not a cure-all, but they represent a substantial leap forward. When properly implemented, they allow compliance teams to act faster, assess risk more accurately, and respond before exposure becomes liability.

If your current process still relies on disconnected tools, spreadsheets, or reactive oversight, now is the time to reassess.

Modernizing your KYC environment is no longer optional. It’s operational risk management at its core.

Book your free demo to find out how Business Radar can revolutionise your KYC Compliance: Book Your Demo Here