Adverse media screening tools are a vital part of maintaining an organisation’s integrity. Many people are aware of adverse media monitoring as it relates to anti-money laundering (AML) efforts. Few realise the importance of adverse media screening solutions as they relate to Environmental, Social, and Governance (ESG) issues.

While ESG monitoring often lacks the regulatory guidance that exists for AML practices, it is an important part of business in the 21st century. Customers, investors, employees, and boards expect robust and consistent ESG monitoring. That makes ESG media monitoring a requirement for any organisation that wants to ensure its efforts to be a responsible business entity are successful and respected.

Understanding Adverse Media Screening Solutions

Adverse media monitoring or screening (also known as negative news screening) refers to searching global news sources for unfavourable information about an individual or organisation.

This process has become an essential part of risk management and due diligence, not only to detect financial crime but also to evaluate Environmental, Social, and Governance (ESG) media. In fact, adverse reports are often the clearest indicator of a third party’s ESG status, as negative news can reveal allegations of environmental violations, labour abuses, corruption, and other ESG-related misconduct.

With growing regulatory and stakeholder expectations around ethical business conduct, companies are increasingly leveraging automated adverse media screening tools. These tools use vast data feeds and advanced algorithms to continuously monitor news and flag potential risks in real time.

This report reviews five leading adverse media monitoring solutions in 2025. Looking at features, coverage, and unique strengths followed by a brief comparison of how they stack up against each other.

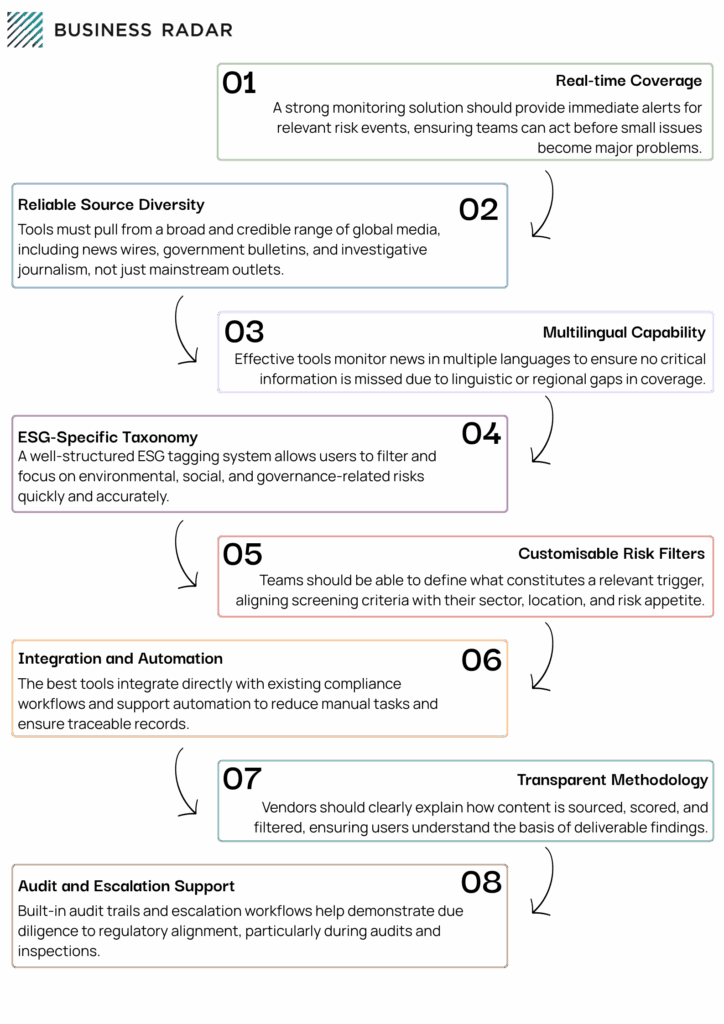

What to Look for in an Adverse Media Screening Tools

Before comparing tools, it’s critical to understand what sets effective adverse media screening solutions apart. At a minimum, these platforms must go beyond simple keyword searches to deliver meaningful, actionable insights. Key capabilities to look for include: Real-time Coverage, Reliable Source Diversity, Advanced Filtering, Machine Learning Capabilities, Global Reach, Custom Alerts & Reports, Seamless Integration, Scalability.

These criteria form the benchmark for evaluating adverse media screening tools in the next sections. Each tool reviewed has been analysed against these features for performance, reliability, and relevance to ESG-related risk management.

The 5 Top Adverse Media Screening Tools for 2025

Here are the top five adverse media screening tools currently available. While there are scores of competitors, these five have been chosen for this comparison.

1. ComplyAdvantage

ComplyAdvantage is a RegTech platform that employs artificial intelligence (AI) and machine learning (ML) to deliver real‑time adverse media screening tools. The platform analyses tens of millions of sources. These include international and local news outlets, court records, government websites, and specialist blogs-to identify and structure adverse media related to sanctions, politically exposed persons (PEPs), and environmental, social, and governance (ESG) issues. Alerts are delivered via an intuitive API, enabling compliance teams to integrate screenings seamlessly into their workflows (ComplyAdvantage, n.d.).

Strengths:

- Extensive Source Coverage: Monitoring over 11,000 verified media sources across 200+ countries ensures broad geographic and linguistic reach

- Structured Entity Profiles: AI-driven aggregation creates consolidated entity profiles, filtering out noise and reducing false positives

- Rapid Detection: Daily refresh cycles and continuous monitoring uncover emerging ESG media reports, such as environmental controversies or labour issues.

- Scalable Integration: The platform’s API-first design supports integration with existing KYC, AML, and risk management systems, enabling smooth automation

Weaknesses:

- Transparency Challenges: The reliance on proprietary ML models may limit transparency into how adverse media content is classified or scored. This could challenge compliance auditability.

- Context Limitations: While broad in scope, automated summaries may overlook nuanced local context without supplemental human review.

- Cost and Complexity for Small Firms: Even though ComplyAdvantage offers tiered pricing (e.g., starter plan at around US$99/month), smaller organisations may find enterprise-level features excessive.

Typical Use Cases:

Financial institutions, fintechs, and global corporations employ ComplyAdvantage to expedite onboarding, enhance ESG monitoring, and maintain traceable audit trails in compliance workflows.

2. World‑Check One (LSEG)

World‑Check One, part of the London Stock Exchange Group’s Risk Intelligence suite, combines a robust screening platform with a rich database of adverse media screening tools, sanctions, and PEPs. The platform delivers globally sourced, structured risk intelligence, supported by a team of over 400 analysts and research centres across five continents. In total, the database holds more than 4 million detailed profiles, derived from reputable media outlets, regulatory bodies, and enforcement agencies (LSEG, n.d.)

Strengths:

- Structured and Curated Data: Every record is verified against stringent criteria-including sanctions, legal actions, or adverse media-and encapsulated in structured profiles for easier analysis and decision‑making

- Broad Coverage: Sourced from over 100,000 outlets spanning 240 countries in 65+ languages, including ESG‑related categories like environmental crime, human rights, and wildlife trafficking

- Customisable Searches: Users can configure matching thresholds, specify risk categories, and apply secondary matching to refine results and reduce false positives

Weaknesses:

- Cost & Complexity: The enterprise-grade nature and extensive functionality may pose high licensing costs and implementation overhead unsuitable for smaller organisations.

- Less AI Automation: While highly reliable, the manual and curator-driven processes can limit rapid automation compared to newer AI-native solutions.

- Potential for Alert Overload: Broad coverage may result in high alert volumes, necessitating significant tuning and analyst time to manage effectively.

- Major News Outlets: LSEG only draws information from major news outlets, potentially causing them to miss items in local news or niche sources.

Typical Use Cases:

World‑Check One is favoured by multinational banks, fintechs, and large corporations for comprehensive KYC, third‑party screening, and ESG monitoring. It excels at uncovering hidden associations-such as corporate linkages or ESG media issues, critical for large-scale compliance programmes (LSEG, n.d.)

Overall, World‑Check One offers an exceptionally reliable and comprehensive adverse‑media screening solution. Its structured data and deep coverage make it a top choice for organisations that demand regulatory-grade intelligence and robust audit trails. That said, its complexity and cost are better suited to enterprises rather than SMEs.

3. Business Radar

Business Radar is a technology-driven adverse media and ESG monitoring platform built to give compliance teams real-time insights into reputational risk. They provide an AI-powered tool that ingests content from over 150 million sources in more than 100 languages. It offers real-time adverse media screening and monitoring, risk categories, and sentiment scoring to support compliance teams in identifying ESG media and reputational threats across jurisdictions. The tool also enables configurable workflows and seamless integration with existing ERP and CRM systems (Business Radar, n.d.).

Strengths:

- Extensive Coverage: Tracks global content in over 100 languages from both traditional and non-traditional media sources.

- Wide Categories: Stay on top of the news that are relevant to your business, filtering for more than 100 categories.

- Workflow Integration: Features like alerts, audit logs, and connector APIs support enterprise-scale deployment.

- User-Centric Interface: Includes filtering, binders, and virtual assistants that reduce noise and improve team coordination.

Weaknesses:

- Opaque Source Breakdown: Transparency around individual source credibility and weighting is problematic, but this is caused by the massive volume of mainstream and gazette media.

- Advanced Features Tiered: Some critical functionality may only be accessible on enterprise-level plans, restricting access for smaller teams.

Use Cases:

Well-suited international organisations, legal/compliance teams, private equity groups, and consultancies requiring multilingual adverse media detection with ESG media tagging and platform extensibility. The massive source pool and smart detection of trade names makes Business Radar uniquely suited to adverse ESG media monitoring. Unlike the competition, Business Radar draws from even the smallest published sources; items that don’t hit mainstream media. These might be ignored by the competition, but get picked up by Business Radar. This increases the confidence the reporting is truly thorough and complete.

“The coverage of Business Radar, especially in specific news regarding ESG developments is unmatched!” – ESG Expert, the Netherlands

4. Dow Jones Adverse Media Screening Solutions

Dow Jones Adverse Media Screening tools offer organisations a structured way to identify reputational and regulatory risk through extensive monitoring of negative news sources. Leveraging the broader Factiva database, the platform enables access to tens of thousands of trusted global sources across newswires, regulatory publications, and online media (Dow Jones, n.d.).

Strengths:

- Source credibility: Dow Jones sources are highly curated and include many reputable outlets, regulatory feeds, and government watchlists. This enhances the trustworthiness of alerts.

- Depth of historical content: The tool offers coverage going back over a decade, helping compliance teams assess long-term reputational risk.

- Language and region diversity: With coverage in over 30 languages and presence in 200+ countries, the system has excellent global reach.

- Structured tagging system: Dow Jones’ Risk & Compliance platform includes adverse media categories like crime, fraud, environmental violations, and sanctions-related content, which streamlines investigations.

Weaknesses:

- Limited UI personalisation: Compared to some newer tools, Dow Jones Watchlist may offer fewer custom visualisation options or user dashboard enhancements.

- Pricing transparency: There is limited publicly available information on pricing tiers, which may deter smaller firms.

- Real-time alerts lag: While not slow, the system is not always as instantaneous as some AI-native tools designed for real-time flagging (Dow Jones, n.d.).

Dow Jones remains a strong choice for firms that value regulatory-grade sources, categorised intelligence, and robust adverse media screening solutions. Its heritage and editorial rigour appeal especially to financial services, law firms, and multinationals with zero-risk tolerance.

Moody’s Adverse Media Screening Solutions

Moody’s Adverse Media Screening solutions, part of Moody’s Risk Intelligence suite, provide timely monitoring of ESG media using AI, extensive data feeds, and document analysis. It draws from reputable sources, such as global news outlets, legal filings, regulatory announcements, and specialist publications, to identify reputational or regulatory risks tied to environmental, social, or governance issues (Moody’s, n.d.).

Strengths:

- Global Source Spread: The platform scans content from over 100,000 reputable sources, including regional news, government databases, and legal repositories across numerous countries.

- AI-Augmented Tagging: Utilises natural language processing (NLP) to classify adverse media into ESG monitoring categories like environmental violations, labour rights abuses, or governance failures. This reduces false positives and highlights material risk topics.

- Holistic Data Integration: Seamlessly integrates with Moody’s broader intelligence offerings, such as Orbis KYC and CreditView, enabling enriched due diligence by combining adverse media with ownership, financial, and credit data.

- Regulatory Compliance Support: Audit trails, timestamped alerts, and source metadata facilitate reporting and regulatory alignment.

Weaknesses:

- Complex User Experience: The breadth of functionality can result in a steep learning curve; pilot customers report needing training to effectively configure filters and workflows.

- Pricing Tier Constraints: Advanced features, such as predictive sentiment analysis, are typically bundled in premium enterprise tiers, making the solution less accessible for smaller firms.

- Latency in Source Update Cycles: Some regulatory and legal source updates may experience delays of several hours to a day, which may be slower than fully real-time systems.

Overall, Moody’s Adverse Media Screening tools are ideal for large enterprises seeking a comprehensive and integrated approach to ESG media monitoring within a broader risk intelligence ecosystem. Its strength lies in combining depth of coverage with strategic analytics and regulatory compliance tools.

Final Thoughts

Each of the five tools profiled (Business Radar, ComplyAdvantage, Dow Jones Risk & Compliance, World-Check One by LSEG, and Moody’s) offer robust ESG-focused adverse media screening tools. All demonstrate a strong commitment to global regulatory alignment, extensive media coverage, and technological innovation.

Larger platforms like Moody’s, LSEG, and Dow Jones bring scale, legacy integration, and advanced analytics to the table, making them ideal for institutions with complex compliance demands or cross-border risk exposure. Their feature sets are broad, often backed by decades of institutional trust and large-scale AI infrastructure.

On the other hand, newer or more specialised entrants like Business Radar offer agility, focus, and user-centric design. These tools often appeal to mid-sized companies or lean compliance teams seeking a more responsive relationship with their solution provider. In many cases, smaller vendors can deliver faster iteration, more customisation, and closer client support, an important factor for businesses undergoing digital transformation or building ESG monitoring from the ground up.

Ultimately, the “best” tool depends on your organisation’s size, industry, and risk profile. Enterprises operating in regulated sectors or across multiple jurisdictions need deep integrations and global scale. At the same time, it’s important to choose a nimble provider focused on ESG monitoring automation. When cost, support, and simplicity matter most, big name providers might not be the answers.

If you have questions about what features your organisation needs, contact the team at Business Radar. We pride ourselves on objectively providing our clients with the information they need to make the best decision for their enterprise. Book your personal live-demo.

Comparison Chart of the Top 5 Adverse Media Screening Tools for 2025

| Tool | Best For | Notable Features |

| ComplyAdvantage | Financial institutions, fintechs, and global corporations needing real-time ESG media and AML monitoring | AI-driven entity profiles, 11,000+ media sources, API-first design, rapid detection, scalable integration |

| World-Check One (LSEG) | Multinational banks and large enterprises with complex compliance needs | Structured profiles, 100,000+ sources, customisable searches, extensive integration options |

| Business Radar | Global organisations, legal teams, and consultancies needing multilingual ESG monitoring insights | 150M+ sources, custom ESG media tagging, sentiment scoring, extensive media coverage, user-centric UI |

| Dow Jones Risk & Compliance | Firms prioritising regulatory-grade sources and long-term reputational monitoring | Trusted Factiva content, 30+ languages, structured tagging, strong editorial control |

| Moody’s | Enterprises seeking integrated risk intelligence with strong compliance reporting | AI-enhanced ESG media tagging, Orbis & CreditView integration, timestamped alerts, 100,000+ sources |