What is KYB?

Every year, the United Nations Office on Drugs and Crime (UNODC) estimates that between €715 billion and €1.81 trillion worth of money gets laundered (Europol, 2022). That’s roughly 2-5% of the worlds yearly Gross Domestic Product (GDP). Money that is “dirty” is derived from illegal activities such as selling drugs. To legitimize this money and introduce it back into the legal financial system in vast quantities, it is laundered, allowing criminals to use the money in legit ways such as buying villas and yachts.

Since the beginning of banks, financial institutions have always looked at how they can avoid dirty money being laundered. That’s why the first dedicated anti-money laundering legislation, known as the Bank Secrecy Act (BSA), was introduced in 1970 in the U.S (Financial Crimes Enforcement Network, n.d.). Since then, due diligence would never be the same. Other countries followed suit, and strict Know Your Business (KYB) and Know Your Customer (KYC) laws were implemented worldwide to evaluate the legitimacy of flowing money. The establishment of the Financial Action Task Force in 1989 further brought the issue to a global stage, as member countries of the FATF universally agreed to cooperate and standardize certain best practices. As of March 2025, the FATF comprises of 40 members, two of which are regional organizations (The European Commission & The Gulf Cooperation Council). The Russian Federation has had its membership suspended as of February 2023 (FATF, n.d.).

KYB, or Know Your Business, is the process of verifying the identity and legitimacy of companies before engaging with them. It is a critical component of Anti-Money Laundering (AML) efforts, but its use extends beyond that, supporting fraud prevention, regulatory compliance, risk management, and third-party due diligence. The goal is to confirm that a business is genuine and to identify potential risks before entering a commercial relationship.

KYB Verification processes aim to tackle and verify the following aspects of due diligence:

Verifying the business

- This process involves identifying and confirming the profile of a business. It usually includes the verification of the business name and address, its registration documents and its taxpayer ID number (TIN).

Conducting risk assessments

- Thoroughly understanding the relationships, purposes and environments of the business in question is key to conducting a thorough risk assessment. A key aspect is to understand the entire corporate structure of a business, including all subsidiaries worldwide.

Identifying and screening direct and indirect owners

- Ultimate Beneficiary Owners (UBO’s) are the person(s) ultimately in control of the company – though they may not always be listed as official owners or shareholders. UBO’s typically own at least 25% of company shares or exercise a high level of control over the company, sometimes through a trust or alternative legal arrangement. Screening them is a key element of KYB verification, as these entities may be linked to sanctions, political parties or money laundering crimes.

Ongoing due diligence

- Simply screening a company once in accordance with KYB compliance regulations during onboarding is no longer enough. Companies must be monitored continuously for any suspicious activities or transactions. An ongoing process of due diligence is required to flag up any suspicions.

Need an overview? We’ve got you! Download our KYB Checklist here and stay on top of Knowing Your Business!

KYB vs KYC

KYC – or Know Your Customer – is a process similar to KYB verification. In fact, both share a common objective – to comply with AML regulations and ensure the safety of financial transactions, preventing the laundering of money. However, where KYC focuses on individuals and customers who must comply when named, KYB compliance regulations focus on addressing corporations, businesses and other entities.

When is KYB relevant?

KYB compliance screening is relevant in any sector where businesses are required to verify other businesses for regulatory, risk management or compliance purposes. Some examples include:

| Industry | Examples | Applications |

| Finance | Banks, FinTech companies, Neobanks | Legal requirements to verify businesses onboarded to prevent fraud and money laundering. |

| Crypto, Blockchain | Exchanges, wallets, DeFi platforms | Staying compliant with AML and counter-terrorism laws in unregulated markets. |

| E-commerce | Amazon, eBay and B2B marketplaces | Ensure sellers on websites are legitimate and compliant to laws. |

| Insurance agencies | Credit risk insurance, B2B insurance | Assess business legitimacy and risk before offering insurance. |

| Logistics and Supply Chain | Manufacturing companies with big supply chains, companies with large logistics operations. | Verify third party vendors and partners to mitigate risk and ensure compliance with international sanctions, tariffs and laws. |

Why is KYB important?

- The importance of KYB compliance is multi-faceted. During a time of intense global tensions, a rise in wars and trade wars, and overall global instability, verifying who you do business with has never been more important. In fact, Reuters notes that 70% of compliance professionals notice a shift in attitude; where compliance was previously seen as a “tick it off” task to adhere to regulations, it is now an integral part of business strategies (Reuters, 2023). There are key reasons why KYB verification is important:

Regulatory compliance

- All member countries of the FATF must ensure an adherence to a similar minimum standard of due diligence and KYB processes. These members also agree to cooperate and work together on an international level to establish proper anti-money laundering (AML) and counter terrorist financing (CTF) regulations and laws. It is therefore imperative that companies located in FATF member countries oblige to these regulations. Failure to comply can lead to unlawful business.

Fraud prevention

- KYB processes can prevent fraud through the detection of fake or shell companies, which are used to open bank accounts and process illegal transactions. This is a key step in laundering dirty money for criminals.

- KYB checks verify a company’s legitimacy through their registration, operating address, UBOs and corporate structure. This helps track and flag suspicious entities, companies and transactions.

- Fraud rings, which are multiple companies set up and linked between each other to hide illegal activities such as money laundering, can also be blocked via KYB compliance.

Risk assessment

- Without identifying who exactly is behind a business, it is impossible to gauge the level of risk when onboarding or doing business with them. Strong KYB processes can turn a suspicion into a conclusion, allowing quick decision making.

- As situations change quickly, a continuous risk assessment is required. Continuously monitoring and conducting KYB checks helps keep an updated, real time risk assessment of companies.

Reputation protection

- Through proper KYB processes, a company can protect its own reputation by knowing exactly who they do business with. This keeps suspicious and criminal entities far away. The risks of reputational damage from doing business with criminal entities can be severe – as we discovered on our previous blog looking at adverse media and how to monitor the reputation and sentiment of your company in the media.

- There are real, negative implications of failing to conduct proper KYB checks – from association to the company and regulatory issues to weakened stakeholder confidence and internal culture damage. Trust is hard to build, and once it is killed through association with crime, it is extremely difficult to recover.

Supply chain integrity

- Supply chain integrity follows the idea of ensuring that big companies with complex supply chains have vendors, suppliers, contractors and partners who are legitimate, compliant to law, ethical and stable. Failure to ensure this puts your business at risk of trading with unvetted, suspicious and high-risk third parties that can disrupt business operations and reputation.

- A strong KYB screening solution also avoids financial consequences for companies. If a vendor or supplier repeatedly has money issues and has adverse media written about this, companies should think twice before trusting them with products and other potentially sensitive information. The risk of insolvency can have detrimental effects on a supply chain.

Consequences of failure to conduct thorough KYB checks

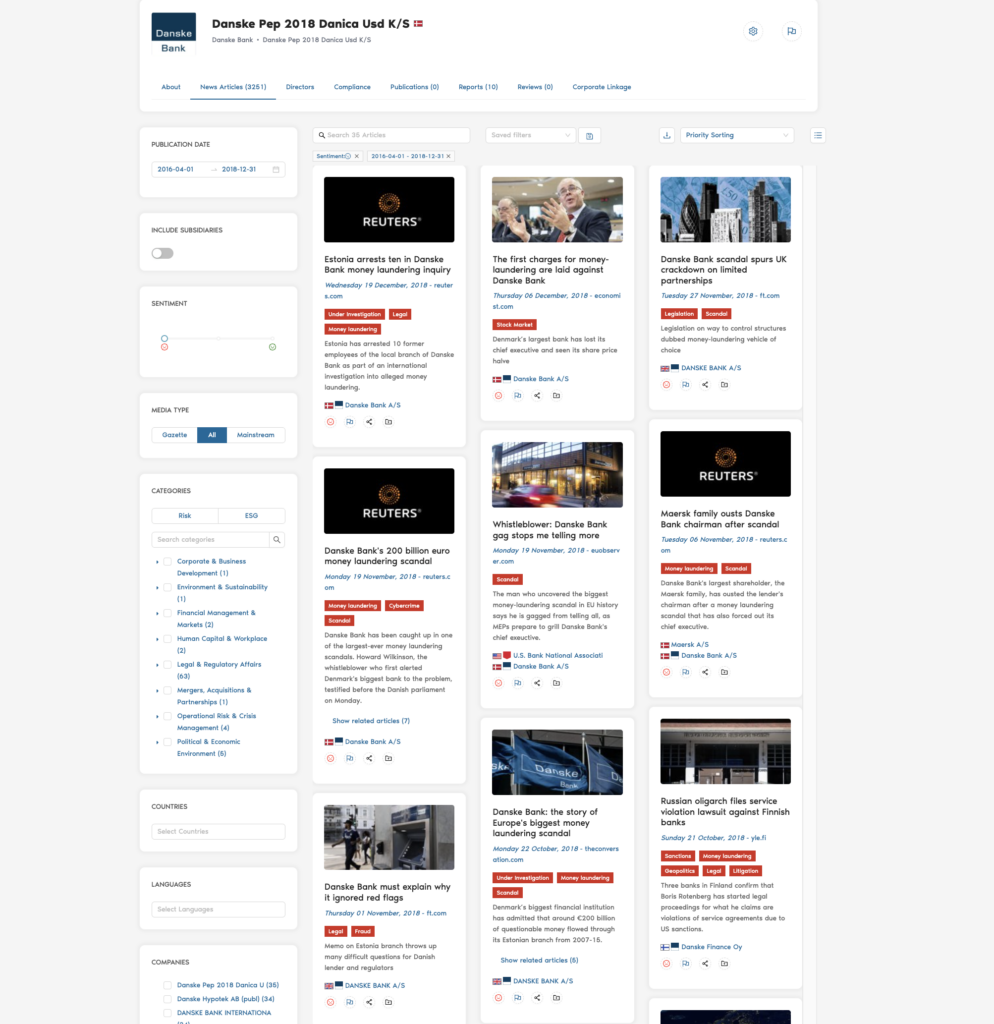

Danske Bank Scandal

In 2017, the Estonian Financial Supervision Authority published a report on Danske Bank – Denmark’s largest bank – and found over €800 billion worth of suspicious transactions in their Tallinn branch. It has since become the biggest money laundering scandal in Europe. Here’s what happened (U.S Department of Justice, 2022):

- Incoming funds from Estonia, Russia, Latvia, Cyprus, the UK and over 150 other countries were laundered and distributed between each other and various other countries around the world.

- Ten former employees of the local bank branch were arrested by Estonian authorities in December 2018, and the branch closed its doors in 2019.

- Investigations uncovered inadequate KYB procedures, allowing high-risk clients to access the U.S financial system through Danske Bank’s Estonian branch.

- Admitting to defrauding the U.S and covering up AML deficiencies, the bank was fined $2 billion by U.S and Danish authorities.

- Thomas Boregen, CEO at the time, resigned in 2018 and was charged by Danish authorities in 2019 for neglecting responsibilities. The banks former finance director, Henrik Ramlau-Hansen, was also charged with failure to prevent suspicious transactions.

ING Bank Money Laundering Case

In 2018, a leading financial institution in the Netherlands, ING Bank, faced allegations of failure to prevent money laundering (Netherlands Public Prosecution Service, 2018).

- The Dutch Prosecution Service found that between 2010 and 2016, many ING clients could take advantage of ING’s inadequate AML and KYB policy implementation.

- Inadequate screening meant that many high-risk clients onboarded – resulting in the laundering of hundreds of millions of euros.

- Due to ING’s failure of vetting clients and monitoring suspicious transactions, telecom company VEON was able to secure contracts in Uzbekistan by paying bribes through ING.

- The case was settled in 2018, and ING agreed to pay a fine worth €775 million.

Having established what KYB compliance is, and why it’s so important for companies in various industries, the next steps are finding the right ways of implementing KYB verification processes into your business’ workflow.

At Business Radar, we provide seamless integration into your systems for the most thorough KYB checks that reduce false positives by up to 90%. Book a demo today and see how Business Radar’s all-in-one solution can help automate your KYB processes, saving you time and money while ensuring the most reliable results.