Cardinal Health, Inc.

Location

Ohio

Founded

1979-02-28

Website

Risk Signals

3280 news mentions monitored

Industry Context

This company is tracked across risk categories, including those related to its sector (e.g., Medical, Dental, and Hospital Equipment and Supplies, Drugs, Drug Proprietaries, and Druggists' Sundries, Management Services), including supply chain integrity, ESG practices, labor disputes, and regulatory compliance.

Filter risk signals by topic

Select a theme below to explore the company’s news mentions in specific risk areas.

Recent Articles about Cardinal Health, Inc.

Live alerts from global media, monitored by Business Radar

2025-05-01 (forecastock.tw)

Cardina Health's earnings per share forecast for fiscal 2025 has been raised to $8.05-8.15, driven by strong drug growth and mergers and acquisitions! |

Cardina Health CEO announced its outstanding performance in the third quarter, updating its earnings per share forecast for fiscal year 2025, showing the company's stable business model and growth potential.

Read more

2025-04-23 (beckersasc.com)

Inside the standout physician group deals of 2024 -

Although physician medical group transaction volume declined by approximately 20% in 2024 compared to 2023, according to VMG Health, several high-profile acquisitions still took place. In its 2025 Healthcare M&A Report, released on April 22, VMG highlighted eight of the most significant physician group deals of the year. 1. In January 2024, private equity firm […]

Read more

2025-04-15 (beckersasc.com)

Cardinal Health's acquisition of GI Alliance: What is means for the industry -

In November, Cardinal Health acquired a majority stake in GI Alliance for $2.8 billion, one of the largest transactions in the gastroenterology space in recent years. Here are five key takeaways from the deal: 1. The acquisition reflects a growing trend of pharmaceutical-focused healthcare companies entering the physician practice space, according to a blog post […]

Read more

2025-04-01 (chaindrugreview.com)

Cardinal Health completes acquisition of the Advanced Diabetes Supply Group

ADSG accelerates growth strategy for Cardinal Health at-Home Solutions.

Read more

2025-03-20 (beckersasc.com)

Who's snapping up physicians? 20 deals to know -

Here are 20 deals in the last two years to know involving physician practice and group acquisitions: Private equity-backed groups Amazon Optum CVS Other acquisitions to note:

Read more

2025-02-12 (market.us)

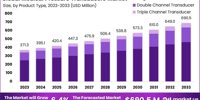

Medical Pressure Transducers Market to Hit USD 690.5 Million by 2033

Medical Pressure Transducers Market size is expected to reach USD 690.5 Mn by 2033 from USD 371.3 Mn in 2023, at a CAGR of 6.4% (2024-2033).

Read more

2025-01-07 (beckersasc.com)

5 recent moves by the 5 biggest GI chains

"Stay updated on the latest news from the top five gastroenterology megagroups in the US - Gastro Health, GI Alliance, PE GI Solutions, One GI, and United

Read more

2024-12-17 (beckersasc.com)

5 moves that disrupted GI in 2024

"Discover the top five disruptions in gastroenterology in 2024, including major acquisitions, reimbursement cuts, and concerns over new screening tests."

Read more

2024-12-13 (marketbeat.com)

Retirement Systems of Alabama Reduces Holdings in Cardinal Health, Inc. (NYSE:CAH)

Retirement Systems of Alabama cut its stake in Cardinal Health, Inc. (NYSE:CAH - Free Report) by 7.8% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 471,711 shares of the company's stock after selling 40

Read more

2024-12-10 (pehub.com)

Advanced Diabetes Supply Group's add-on of US Med was key to scaling the business |

Cardinal Health agreed to acquire ADSG from Court Square Capital for approximately $1.1bn.

Read more

2024-11-27 (pehub.com)

Apollo’s Hybrid Value strategy at work in gastroenterology exit; plus, a look at Arlington’s medical device deal

An “Inside the Exit” story on how Apollo helped grow a physician provider network that Cardinal Health agreed to buy; a look at an exclusive about a medical device maker acquired by Arlington Capital Partners; a market update from investment bank Houlihan Lokey on the freight M&A market.

Read more

2024-11-20 (marketbeat.com)

Retireful LLC Invests $760,000 in Cardinal Health, Inc. (NYSE:CAH)

Retireful LLC acquired a new position in Cardinal Health, Inc. (NYSE:CAH - Free Report) during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm acquired 6,875 shares of the company's stock, valued at approximately $7

Read more